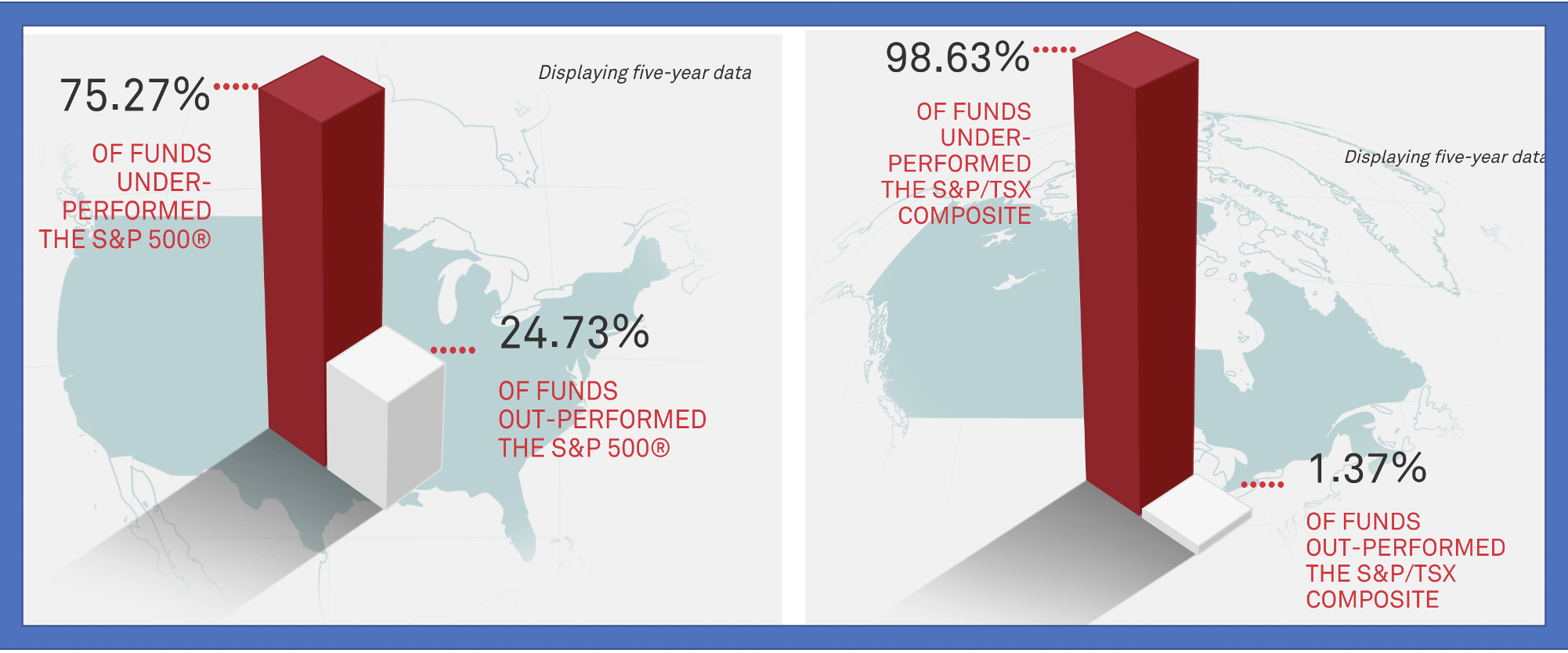

The chart above shows that over a five-year term, 24.73% of US funds and 1.37% of Canadian funds outperformed their respective indexes. These percentages suggest future results.

Some odds!

About one year ago, Forbes magazine published an article titled The Hidden Dangers Of Passive Investing

The author wrote: “If every investor only engages in passive strategies, then large active management opportunities would emerge. I believe that passive investing has become a sufficiently crowded trade that indexers will see lower returns than fundamentally rigorous active investors over the next few years, at least. Passive investors are in the Danger Zone.”

The Monday Morning Program supports the “Danger Zone” passive investing by buying an exchange -traded fund which tracks the S&P 500.

Simply stated (again), our investment philosophy says over the long term, properly selected US market index exchange-traded funds, held in tax-advantaged accounts, in an appropriate asset allocation, have been the investor’s best way for growing savings and are likely to remain so for many years.

The two tables below show the record.

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join Us