The risk/reward relationship is inescapable. The greater the risk that investors take, the greater their possible reward. Note the word “possible” and not “likely”.

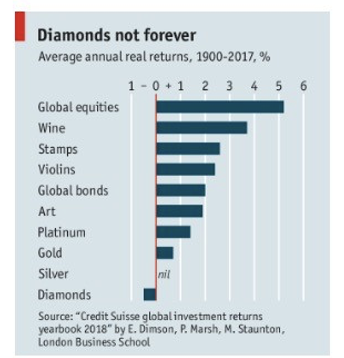

We have frequently shown the chart above which demonstrates that investing in equities has had the best return for over 100 years. That requires that investors have a long-run mindset. In the short run, they risk losing much of their money.

Stated another way, the high long-run returns compensate for the risk of losing a lot of invested money in the short run.

As we stated previously, over the last three years, US market returns averaged over 25% annually, not adjusted for inflation. Over the last two hundred years, US market returns averaged about 10% annually, not adjusted for inflation.

Clearly, we are looking at what Alan Greenspan called irrational exuberance.

Warren Buffett’s mentor Benjamin Graham stated in 1963: “In my nearly 50 years of experience in Wall Street, I’ve found that I know less and less about what the stock market is going to do, but I know more and more about what investors ought to do.”

So, what ought we to do?

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join Us