Universal Life Insurance, a 1980s Sensation, Has Backfired

The above line is the title of an article from the September 19, 2018 issue of the The Wall Street Journal. Unbelievable from the perspective of Monday Morning Millionaire Program members, the article talks about people in their 70s, 80s and even 90s being disappointed with the performance of their life insurance policies. People that age should not need life insurance. What they are really disappointed about is the performance of the investment component of their policies.

There are two types of life insurance – term insurance and permanent life insurance. Term insurance is actuarially sound, pure insurance. Permanent insurance comes in two flavours – whole life and universal life. The differences are unimportant. The critical feature is that in addition to the actuarially sound, pure insurance they have an investment component. The investment component of the universal insurance which The Wall Street Journal article talks about was based on the high interest rates which were available when these policies were sold. As interest rates dropped to the lowest level in history, the investment part of these policies performed increasingly poorly, of course.

The folks selling these aggressively promoted policies were well compensated. Because of the provider intermediation costs, i.e. loads/handsome commissions to sales people, commissions to stock brokers, management costs, advertising, and more, it was impossible for the investment outcome to match simply buying the American economy via a market index exchange-traded fund (ETF).

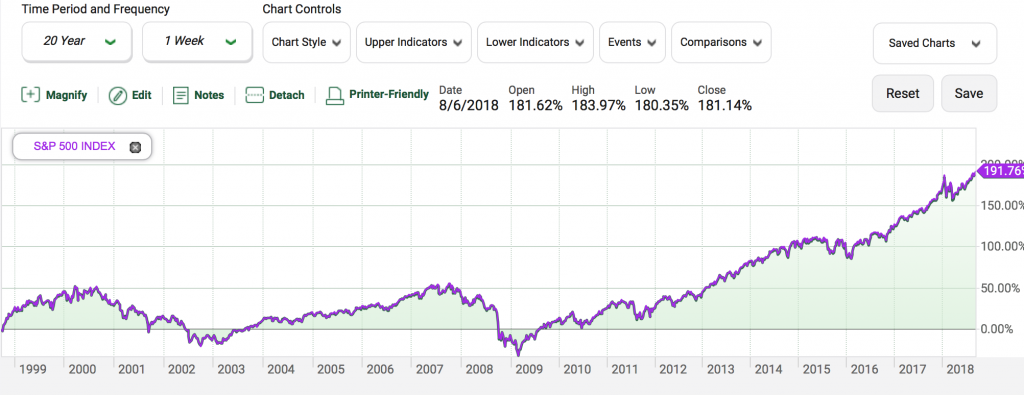

Investors who had the habits promoted by the Monday Morning Millionaire Program were not disappointed. In fact, they did well, indeed. The chart below shows that they earned nearly 200% on their investment during the last 20 years.

So, how do Monday Morning Millionaire Program members approach their life insurance and their investment needs?