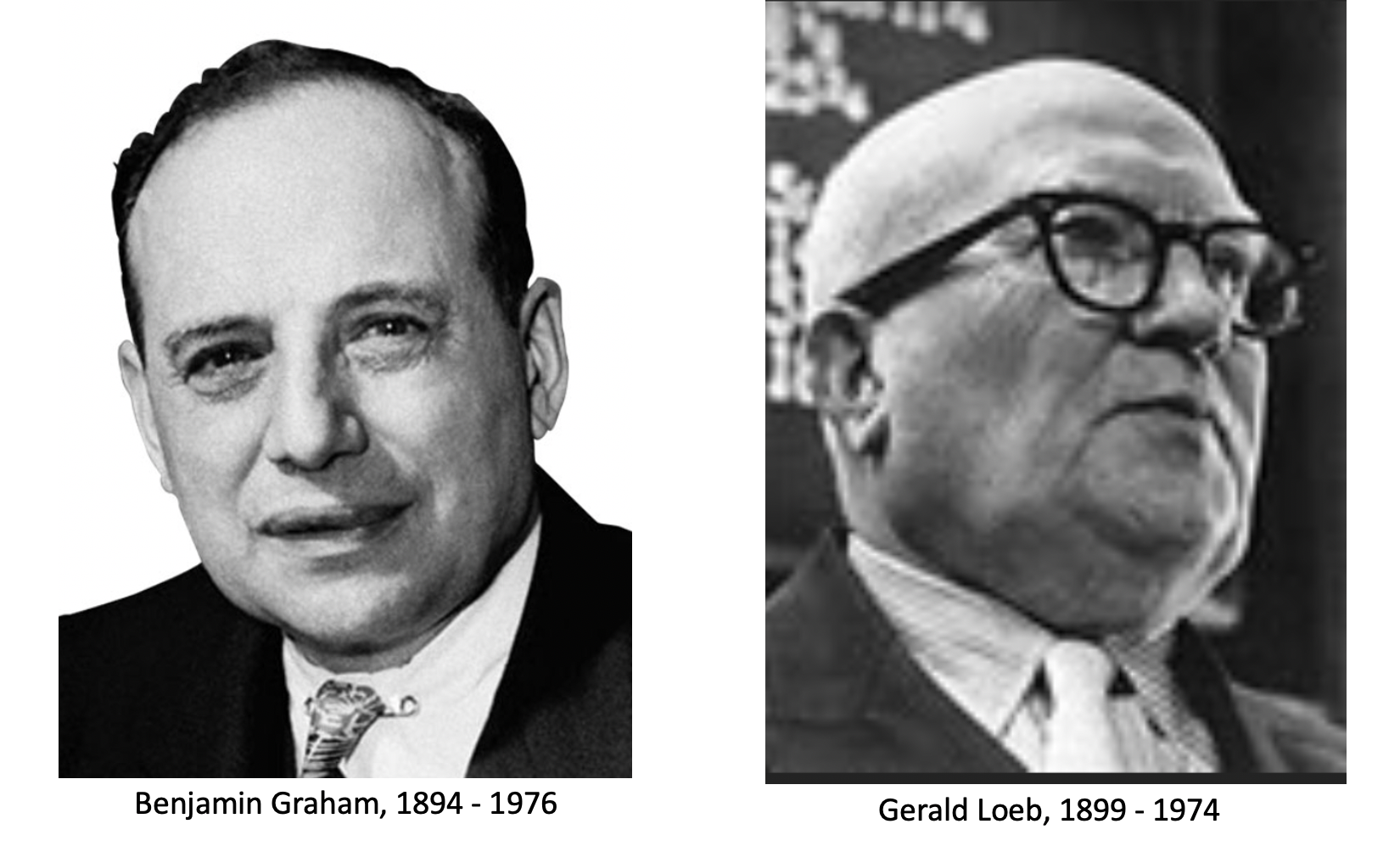

Benjamin Graham once said, “To achieve satisfactory investment results is easier than most people realize.”

Graham is Warren Buffett’s mentor. Warren Buffett is the most quoted man on investing issues.

Gerald Loeb once said, “Any way one looks at it, nothing is more difficult than succeeding in Wall Street.”

Loeb, the author of the highly regarded book The Battle for Investment Survival was the most quoted man on investing issues before Buffett.

“…easier than most people realize…” “…nothing is more difficult…” ???

Graham and Dodd were contemporaries in the same line of work. How their views could be so different is difficult to reconcile.

As we show in our Monday Morning presentations, in less than one hour, we can teach a high school student how to equal the market as represented by the S&P 500. Benjamin Graham speaking.

We also show that over the course of a market cycle (peak to trough to peak), the number of portfolios which outperform the S&P 500 is much closer to 0% that it is to 10%. Gerald Loeb speaking.

So, how do we minimize market declines in our portfolios and maximize on markets that rise?

This is routine thinking to investors with the Monday Morning mindset. We include it here for review and for newer members.

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join Us