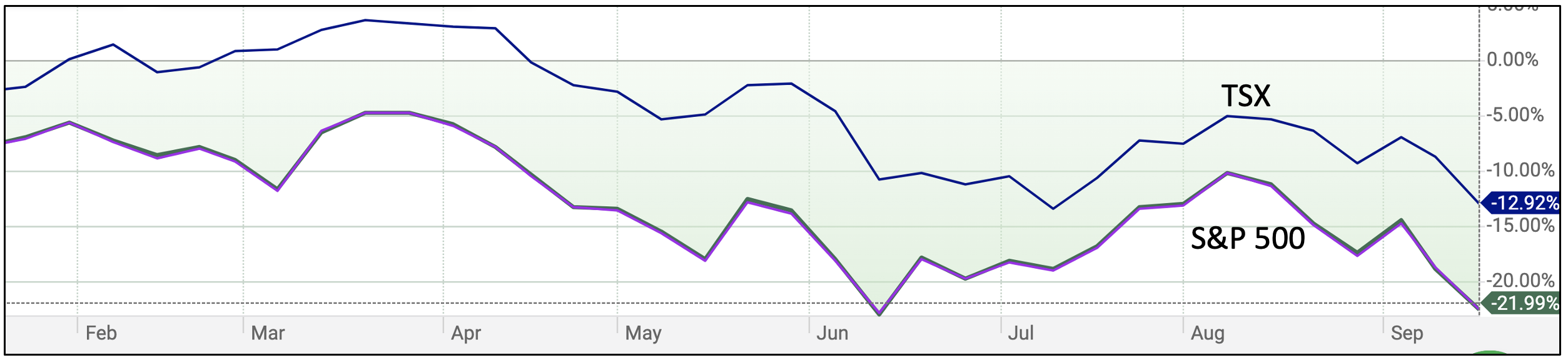

Year-to-date, last Friday, September 23, the Toronto Stock exchange index (TSX) was down nearly 13% and the US market is represented by the S&P 500, was down almost 22%.

Markets go through at least one big pullback every year and one massive one every decade. Get used to it. It’s just what they do. We wrote about that previously.

Without cherry-picking, the US market has been the best place to invest for some 200 years. To deal with the expected massive fluctuations, any money which we will need within the next few years should not be in the market. Also, we should maintain at all times an asset allocation a large part of which is cash or near cash.

60/40 is common, as is 50/50 and similar allocations. The differences are minor. The length of time in the market is major.

What can we expect the markets to do now?

Without a doubt, they will recover and hit new highs. Nobody knows when that will happen but intelligent investors know it will happen.

And what should investors do at this time?

Reviewing our Jan 21, 2019 post add this time would be helpful.

The review will show you what to do.

Luck hardly matters with the habits of the Monday Morning program.

Good luck!