Question:

I am looking to convert my current holdings/stocks into an EFT S&P 500 index fund – what is the best way to do it? Sell everything and just buy the new VOO shares or sell it and dollar cost average into it or another way?

Monday Morning Millionaire Program Answer:

As we have done for over a decade, we attended the 2004 Berkshire Hathaway shareholders’ meeting at which Warren Buffett was asked that very question. His advice to investors was to buy a very low-cost market index ETF such as VOO and not put it all in at the same time “but average in over 10 years”. He stated that investors using this approach will do better than 90% of people who start investing at the same time.

Not surprisingly, he was right. For the 20 years ending in December 31, 2015, the S&P 500 index averaged 9.85% a year. During that period, the average equity fund investor earned a 5.19% return. (Dalbar Inc.)

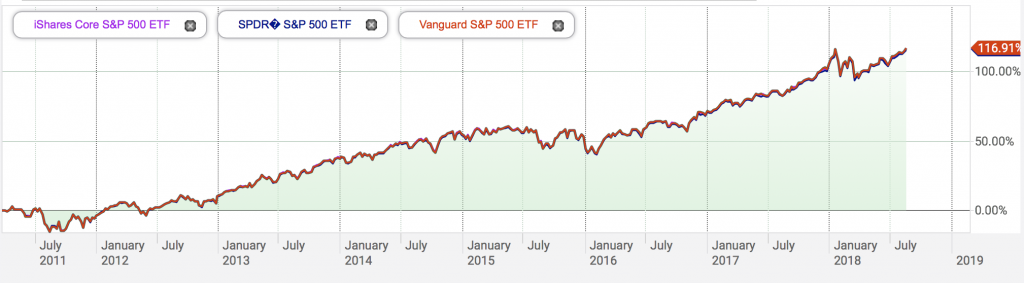

Your choice of VOO shares (Vanguard S&P 500 ETF) is excellent. You are betting on the future of the American economy. Other ETFs that track the S&P 500 are the SPDR S&P 500 ETF (symbol SPY) and the iShares Core S&P 500 ETF (symbol IVV). The charts of these three are identical as you can see below. (The three lines are on top of each other.)

Any of these three ETFs will give you identical results with an equal degree of safety. We are not sure how to “…average in over 10 years” a sum of money but Monday Morning Millionaire Program members have a bulletproof way of dealing with the issue of investing a lump sum regardless of the amount involved.