Our members and subscribers who believe in our investment philosophy would have a 50/50 asset allocation between the US market as represented by the S&P 500 and cash or near-cash (give or take 10% or so in favor of one or the other). The S&P 500 can be represented by an exchange-traded fund (ETF) that tracks the S&P 500. There are thousands of ETFs. About six qualify. SPY is a good example.

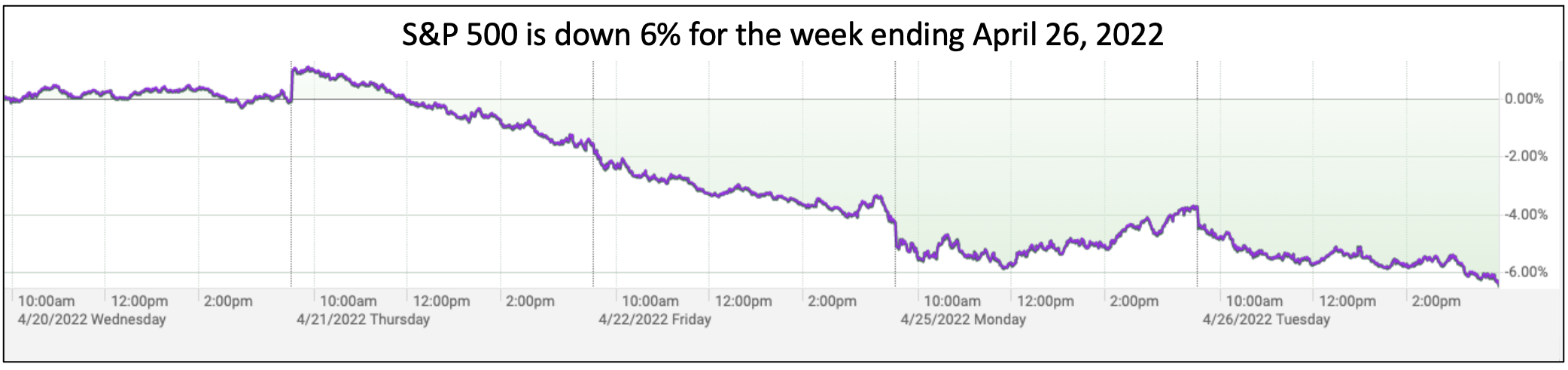

As of yesterday, the S&P 500 is down 6% for the week. The cash or near-cash percentage is up.

Consider buying you more S&P 500 to restore your asset allocation.

How effective is our investment philosophy?

For years now, throughout a market cycle (peak to trough to peak), it has outperformed over 90% of portfolios including professionally managed ones,

Will the S&P 500 drop further? Will it become a greater bargain?

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join Us