The put/call ratio for the U.S. market is negative for several weeks. Interpreting this ratio correctly can be complicated.

To review, a put option gives an investor the right to sell an asset at a preset price called the strike price. If the asset drops below the strike price, the investor makes money.

A call option gives an investor the right to buy an asset at a preset price called the strike price. If the asset rises above the strike price, the investor makes money.

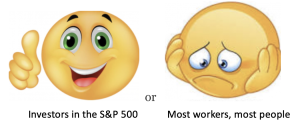

If investors are buying more puts than calls, it indicates a bear market.

If they are buying more calls than puts, it indicates a bull market.

Unlike the put/call ratio, which can be difficult to interpret, an inverted yield curve always accurately forecasts recessions. We should watch for an inverted yield curve; the market could drop into bargain-buying territory.