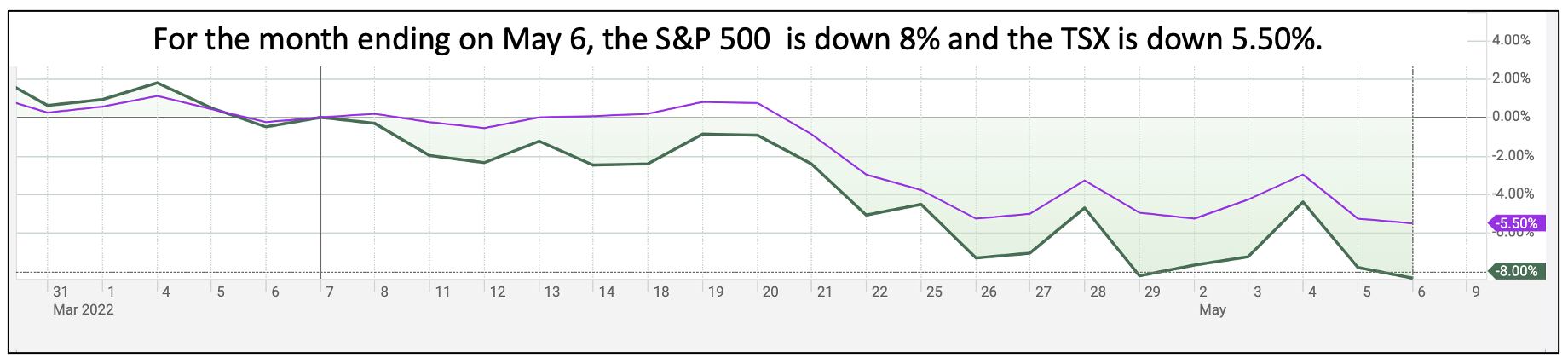

First, if you have not rebalanced your core portfolios recently, consider doing so anytime now. As you can see in the chart above, the S&P 500 is down 8.00% for the month ending on May 6. The TSX is down 5.5%. Bargain territory!

Interestingly, many papers which deal with rebalancing to a selected asset allocation suggest that it be done regularly once or twice a year. Does it not make more sense to rebalance anytime that the asset allocation changes due to market movement?

Next, here is how our fearless, intrepid investor did over the last three weeks in her “fun” portfolio writing covered calls on Novavax (NVAX) on Mondays, expiry dates on Fridays of the same week. To lower the risk of being assigned, she wrote those $10 out of the money instead of the usual just out-of-the-money sale, as she did in the past.

On April 22 expiry date, she sold ten covered call contracts on NVAX and got $US227.50.

On April 29 expiry date, she sold ten covered call contracts on NVAX and got $US547.50.

On May 2 expiry date, she sold ten covered call contracts on NVAX (C 06MAY22 56.00) and got $1,170.00.

Total premiums received = $US1,945.00. In her “fun” portfolio! Most “fun” portfolios underperform and cannot equal the S&P 500. Go here for more about “fun” portfolios,

And the final result? What will she do when the market opens at 9:30 AM, today?

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join Us

The Monday Morning Millionaire Program supports do-it-yourself (DIY) investors which I have been for over 50 years. About my team and me

We have designed the Monday Morning Millionaire Program to offer abstracted investment education. The program does not provide any investment advice or endorsements.

The Monday Morning Millionaire Program has outperformed over 90% of professional managers over the last decade and more. You need to login to see our style. Not a Member? Join Us.