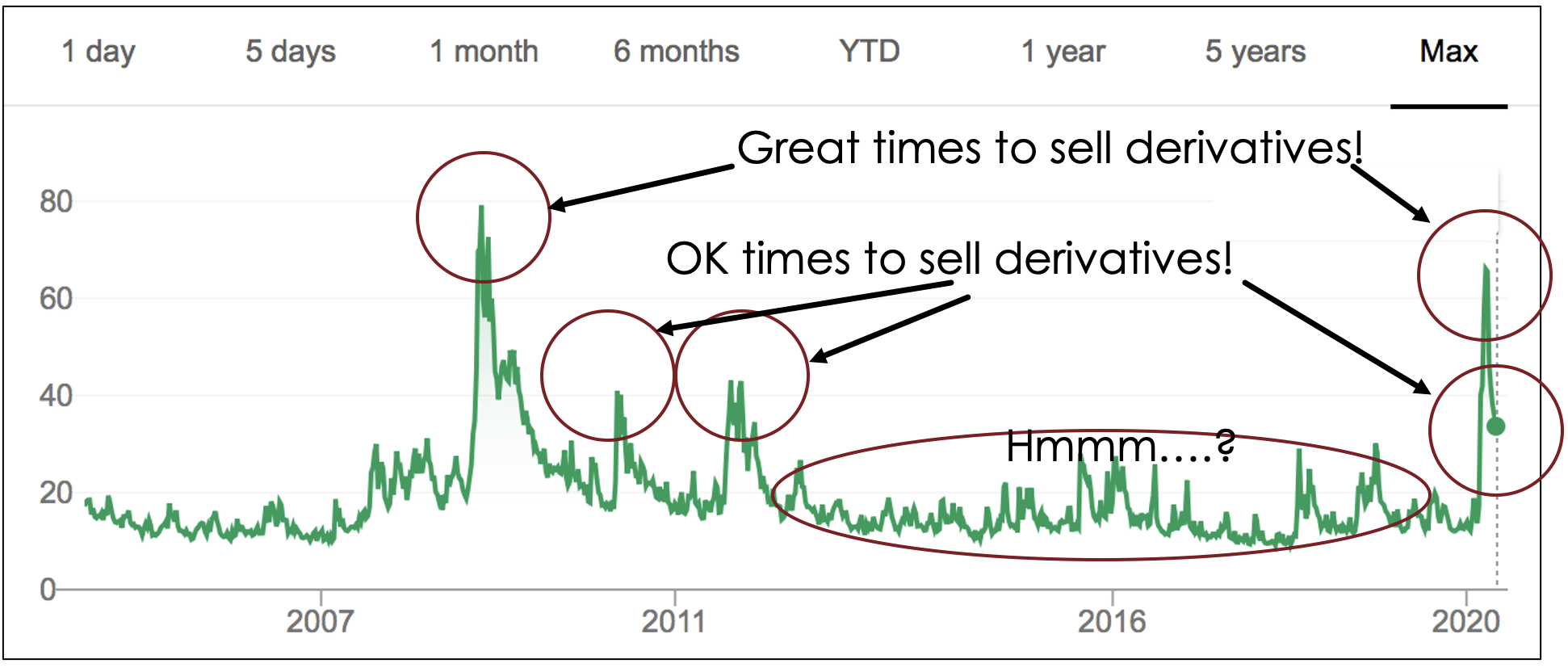

In 2020, there has been a 50 percent rise over 2019 in trading derivatives. Much of this is buying insurance by the big boys. Much of it is outright gambling — it gives speculators huge leverage. Financial weapons of mass destruction, Warren Buffett called this.

After selling (writing) covered calls and cash-secured puts for a while (the Monday Morning program recommends only selling and never buying puts and calls), several of our members noted that they would have been better off simply holding an exchange-traded fund (ETF) that tracks the S&P 500 within their personal asset allocation regime — the Monday Morning approach to investing. This approach is as boring as it is effective. Investing this way needs very little management time.

Is it possible to improve on holding an ETF fund that tracks the S&P 500?

Looking for an answer to the question, we recently posted an article drawing attention to a dozen scholarly, peer-reviewed papers on the subject of puts and calls.

Several of these papers offer actionable ideas, however, what we discuss here is unique. Let us call it the Monday Morning Method of selling covered calls.

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join Us