Joel E., DDS, Canadian dentist, wrote the post below. It provides the answer to a significant issue for investors writing covered calls, namely being assigned.

Many investors writing covered calls are unhappy when they are assigned because their underlying security market price exceeds the strike price at which they sold covered calls on it. In a rising market, they must buy this security back at a higher price to stay in the game. Therefore, they are selling low and buying high. Habit five is “buy low, sell high”.

Here is a strategy I use to avoid that possibility.

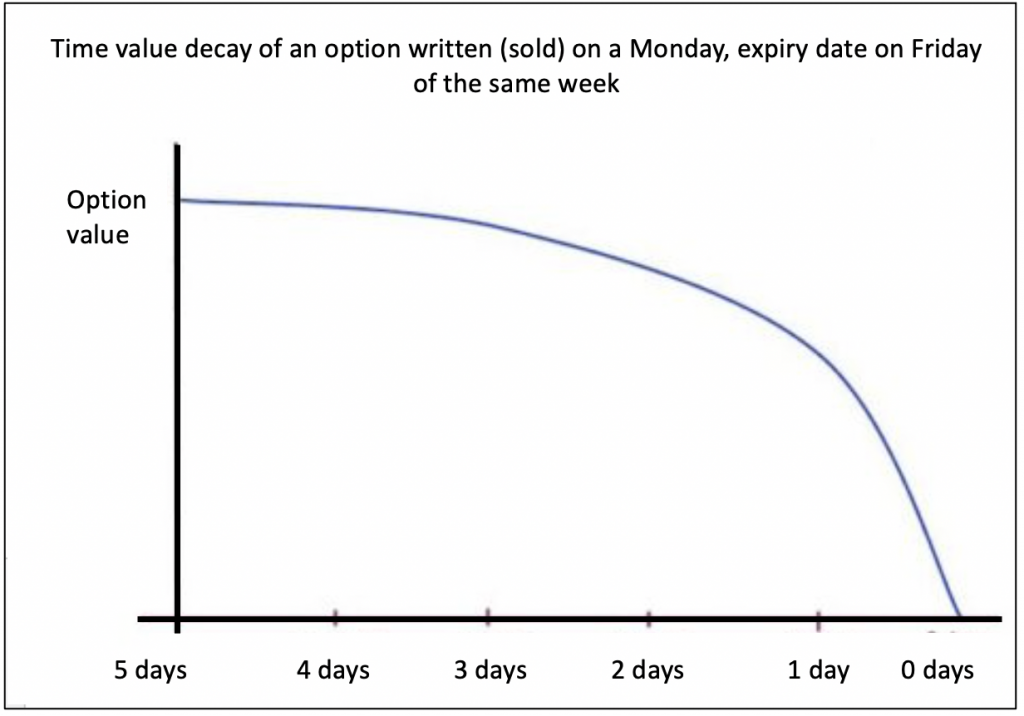

Anytime that the market price exceeds our covered call strike price, our shares can be called away. However, assignment generally happens on a Friday at the closing bell. Therefore, if we check on a mid-Friday afternoon and see that the share price has risen above our strike price (that is, our shares are in the money), we can close our position before the shares are called away by buying them back (same strike price, same expiry date, buy to close). Because of the time value decay of an options contract, we will be paying less when we buy to close later in the week than we received when we sold to open on the Monday of that week. We get to retain some of the premium that we received.

In a declining market, we can buy to close earlier in the week and then sell to open at the same expiry date at a lower just out-of-the-money strike price and earn more premium income.