At 1:00 PM today, I will appear on the program Modern Investing on IBM TV with Sasha Starr.

Here is the YouTube link: https://www.youtube.com/watch?v=rnX1BOJD2qg

I will show a PowerPoint presentation that Monday Morning Program members understand well. You can watch it any time. We welcome your comments.

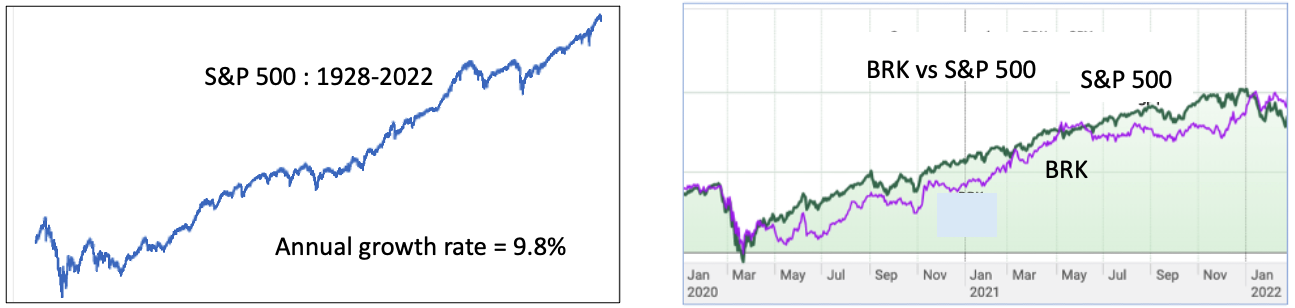

Now, let us talk about the US stock market, the best-performing market over the last 200 years. With fluctuations, it has gone up an average 0f 9.8% per year since 1928. In general terms, it has been the investor’s best way to grow savings. Of course, we can cherry pick other investment that have done better, say San Francisco and Toronto real estate. But then, to compare apples to apples, we need to cherry pick stock market-listed securities such as Facebook, Amazon, Apple, Netflix, Google and Tesla. For every investment that has done exceptionally a well, there are hundreds which never made it and which never heard of.

So, habit number three is to buy the US market as a whole by purchasing an exchange-traded fund which tracks the S&P 500. SPY is a good example. No stock picking.

Warren Buffett, one of history’s bests investors could not equal that approach between 2020 and 2022. Look at the chart comparing his company BRK, to the market as shown by S&P 500. He stated:

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join Us