I had a one-hour one-on-one Zoom meeting with a new member recently. He was paying his financial advisor $20,000 annually. Of course, as members of the Monday Morning Program know, after fees, his financial advisor, like the majority of them, could not equal the performance of the market. Simply buying an exchange-traded fund that tracks the S&P 500, that is, index investing, equals market performance.

Our new member is saying goodbye to his financial advisor, becoming a do-it-yourself investor and saving that $20,000 annually for the rest of his life.

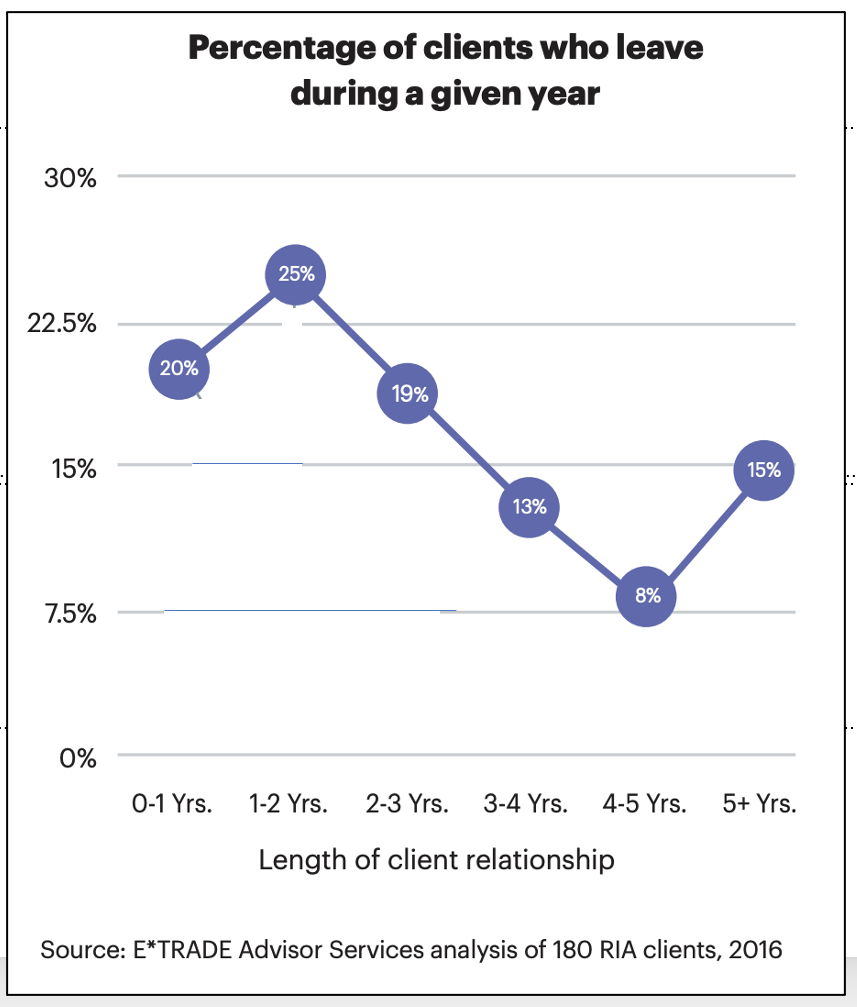

Many of our members, partly Canadian, partly American, are dentists, veterinarians and optometrists. The chart at the top of this post is foreign territory to them. Financial advisors live with it.

Anyone who is able to complete the training which our members have had can easily equal market performance by index investing. They could teach high school students how to do it.

I know several financial advisors. All are decent human beings providing a service for clients who are not interested in being do-it-yourself investors.

For do-it-yourself investors who buy into the American economy as represented by the S&P 500, saving on advisory services might well be the easiest money they ever made.

With the habits of the Monday morning program, luck hardly matters.

Good luck!

________________________________________________________________________

We have designed the Monday Morning Millionaire Program to offer abstracted investment education. Over the last two decades, the program has outperformed over 90% of portfolios, including professionally managed ones.

The program does not provide any investment advice or endorsements.

Members can read our posts in less than five minutes. Following and studying the links embedded in these posts would take longer. How members manage a post depends on their level of interest and investing knowledge.