We have entered bear market territory defined as securities prices falling 20% or more from recent highs.

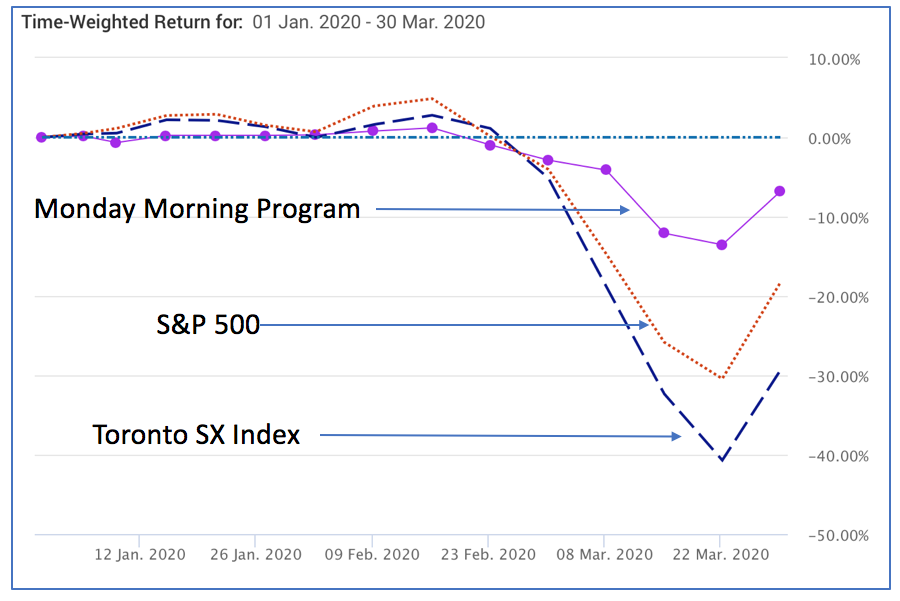

The chart below compares the 2020 first-quarter results for Monday Morning Program members’ portfolios to the S&P 500 and the Toronto Stock Exchange Index. (Source: TD Bank)

(A time-weighted return ignores contributions and withdrawals during the time period being considered.)

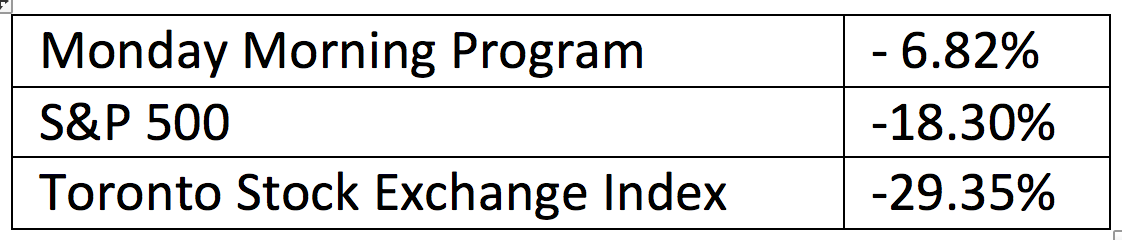

Shown as a table

Much like a rising tide lifts all boats, garbage included, a falling tide drops all boats, quality included. But quality does not drop as much.

How did Monday Morning Millionaire Program members get less than half the drop compared to the S&P 500?

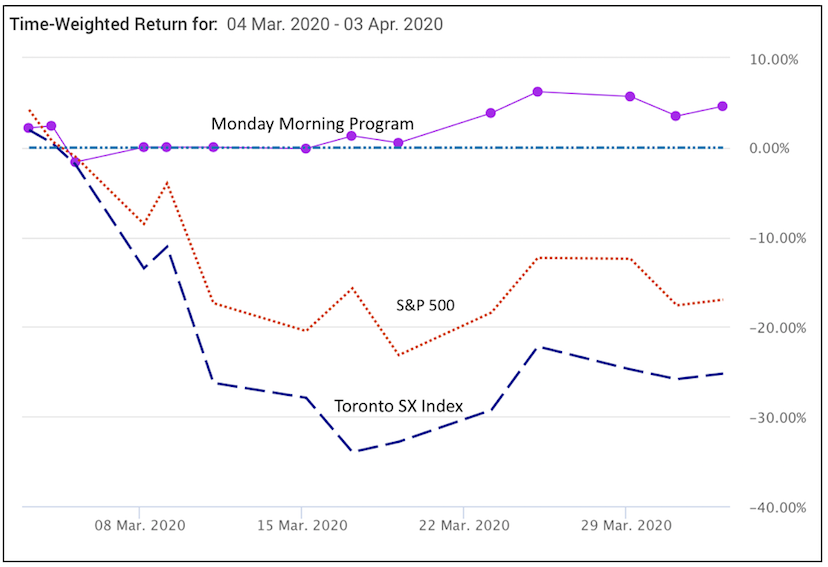

And month-to-date, one week later? The chart below tells the tale. (Source: TD Bank)

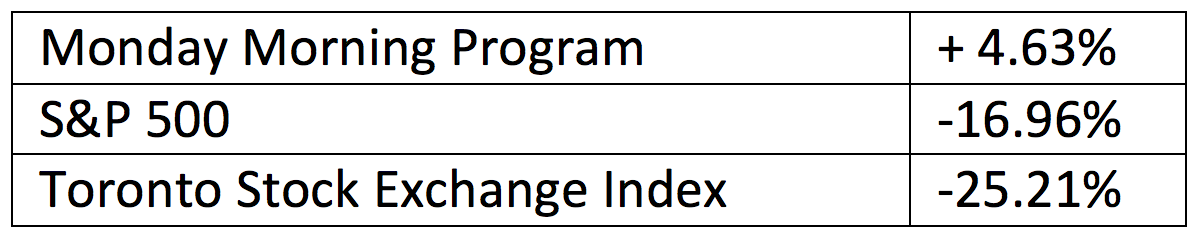

Shown as a table

The performance difference is significant. The Monday Morning Millionaire Program is making money in a falling market.

What is behind it?

No, it is not short selling. Short-sellers can make money in a bear market, it is true, but the Monday Morning Millionaire Program recommends against it.

Short selling can lead to catastrophic losses.

Before we get into the details of making money in a falling market, please note that next Monday’s post will be an interview with a Florida dentist whose portfolios add up to $20 million!

Now, the explanation for the performance follows.

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join Us