On November 1o I published a post titled Why I hate weekends! The reason I hate weekends is because I cannot invest in the stock market.

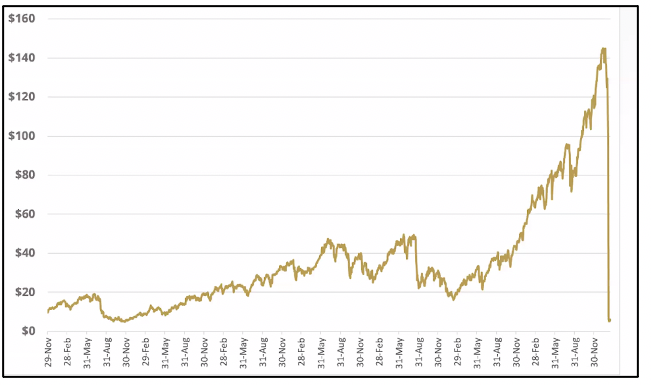

But then, I looked around and found out that the Tadawul, the Saudi Arabian stock market is open on Sundays! Rosi and I invest in SPY which tracks the S&P 500. The Tadawul equivalent of SPY is KSA.

For KSA vs. SPY comparisons including fees, performance, dividend yield and holdings follow:

https://www.google.com/search?q=Investing+in+the+Tadawul%2C+the+Saudi+Arabia+stock+market&oq=Investing+in+the+Tadawul%2C+the+Saudi+Arabia+stock+market+&gs_lcrp=EgZjaHJvbWUyBggAEEUYOTIGCAEQRRg8MgYIAhBFGDzSAQgzNjI1ajBqNKgCALACAQ&sourceid=chrome&ie=UTF-8

Rosi and I have invested in an income property in Collingwood which we will be selling about a year from now. We will invest some of that money we receive in KSA and write (sell) covered calls and cash- secured put on it.

When we do that, we will report our results.

If any of you invest in Tadawul sooner please let us know how you make out.