A sincere thank you to all of you who bought memberships in the Monday Morning program as gifts. If you have not done so, consider it.

Yesterday’s Wall Street Journal had an article on the current inflation rate. At 6.7% for November, it is the highest in nearly 40 years for that month!

Not guilty. The annual membership fee for the Monday Morning program went from $300.00 to $12.00! Further, membership shows only how not to be hurt by inflation but how to prosper in such an environment.

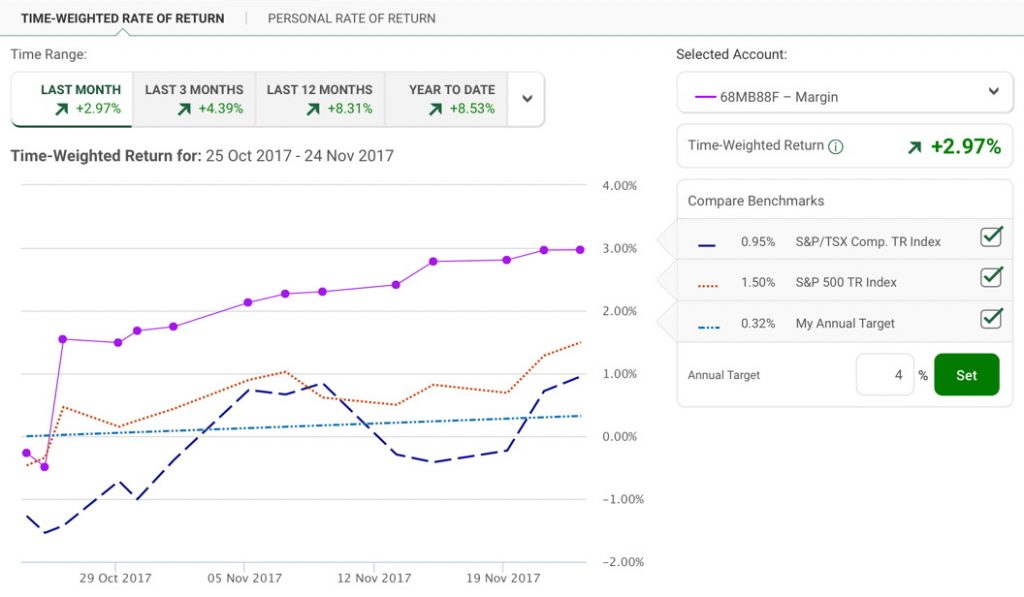

At a growth rate of 6.9%, the largest monthly gain for 2021, the S&P 500 rose at a rate comparable to the inflation rate. Inflation taxed the gain for the month at nearly 100%!

For the month. What about for the year?

The S&P 500 is up 22% – way ahead of the inflation rate.

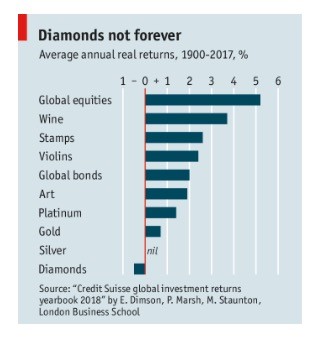

History shows that stock market real returns, that is returns minus inflation, have averaged above 5% annually for over 100 years. No other investment can match that, generally.

Invest as the Monday Morning program recommends, and you will prosper. Introduce friends and relatives to the program with a gift membership.

With the habits of the Monday Morning program, luck hardly matters.

Good luck!

________________________________________________________________________

We have designed the Monday Morning Millionaire Program to offer abstracted investment education. Over the last two decades, the program has outperformed over 90% of portfolios, including professionally managed ones.

The program does not provide any investment advice or endorsements.

Members can read our posts in less than five minutes. Following and studying the links embedded in these posts would take longer. How members manage a post depends on their level of interest and investing knowledge.