Goldman Sachs headquarters in New York City. It owns several other similar buildings around the world.

Yesterday’s Wall Street Journal had an article titled Wall Street Turns to Goldman for Banking’s Outlook Beyond Covid-19. Studying the article will not improve your investment results.

The last of the Goldman Sachs 14 Business Principles states, “Integrity and honesty are at the heart of our business.” Comforting, right?

In 2020, the US Securities and Exchange Commission (SEC) fined Goldman Sachs one billion dollars (billion, not million) for misbehaving (violating the Foreign Corrupt Practices Act). Over the years, the SEC has fined Goldman Sachs regularly for investor protection violations, mortgage abuses, banking violations, toxic securities abuses and on and on. Not so comforting, is it? By the way, the SEC fines all Wall Street and Bay Street banks regularly.

The Goldman Sachs CEO David Solomon was paid $35 million in 2021. Well deserved, right?

Most Monday Morning Program members don’t understand the Wall Street/Bay Street world.

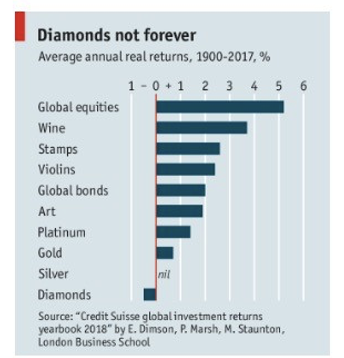

Nevertheless, without cherry-picking examples in real estate, art, individual stocks, and so on, we know that done correctly, investing in the stock market will give investors the best returns.

And how is it done correctly?

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join Us