Owning a home is a part of the North American dream. That is not the case in many countries.

Only 40% of Swiss citizens own their homes. The others rent.

About 60% of Americans and Canadians own their homes. Most of the others hope to, in the future.

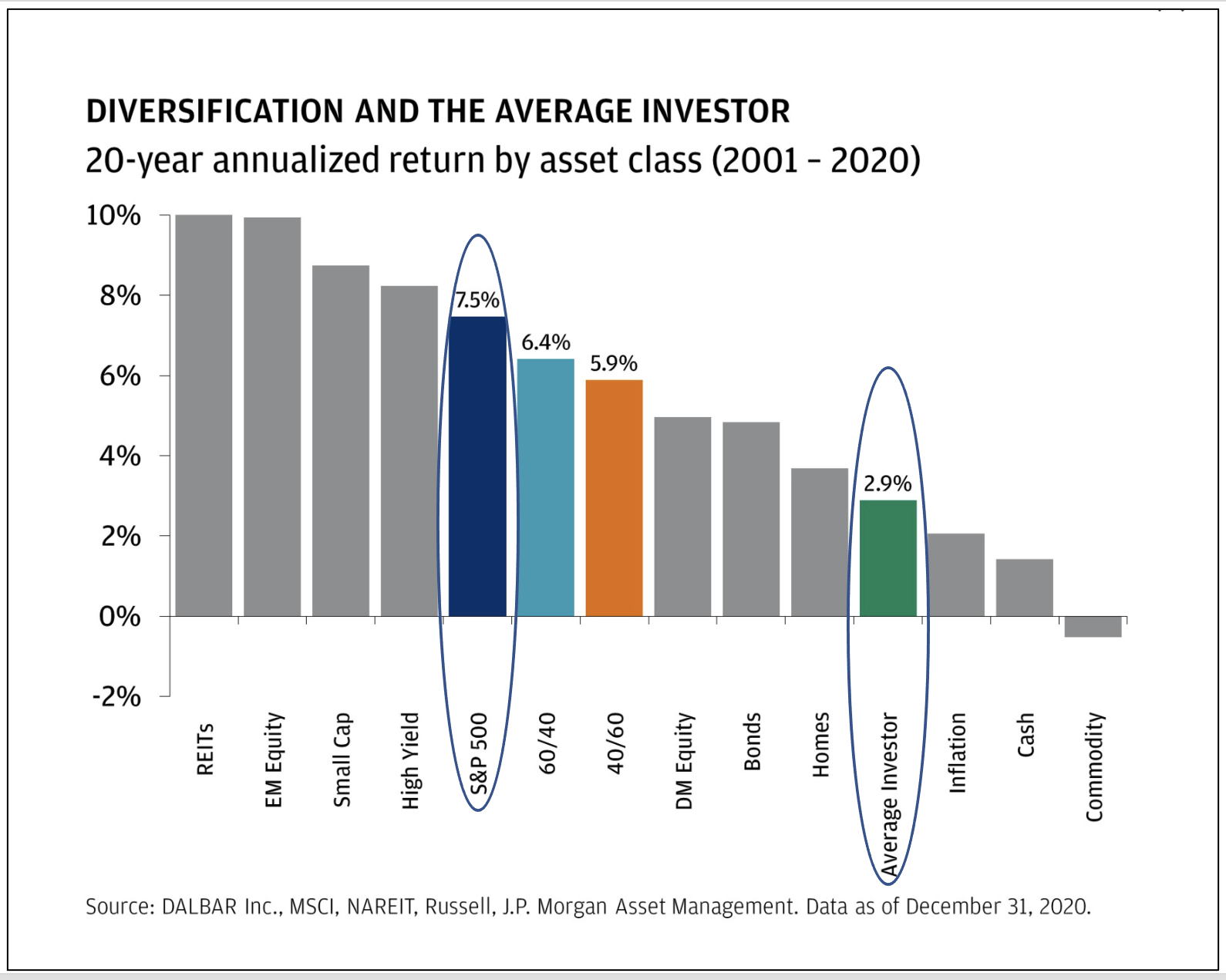

The Swiss have a greater per capita net worth than North Americans. Their per capita GDP is also greater. Do they know something that we don’t?

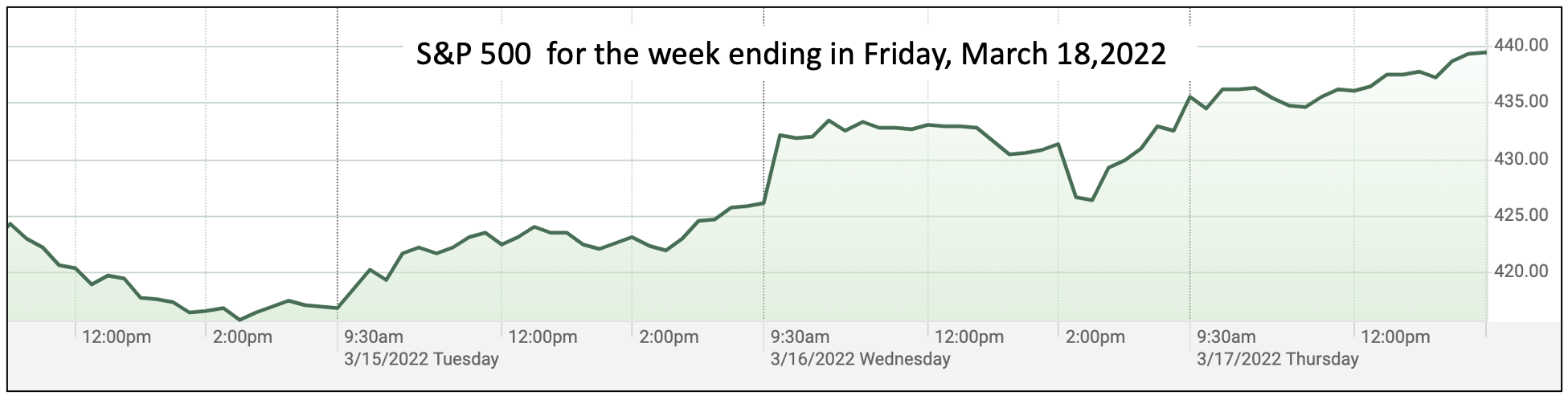

Homeowners in Scottsdale (Arizona), San Jose (California), Rochester (New York), Boise (Idaho), Vancouver (BC), Toronto (ON), have recently seen the value of their homes increase more than the US stock market. The Swiss would be jealous.

However, homeowners in Miami Beach, Naples, Fort Myers, Fort Lauderdale (all in Florida), Columbus (Georgia), Windsor (ON), Sarnia (ON), and several other places have not been so lucky. Many are underwater (their mortgage is larger than the value of their house). Foreclosures are not uncommon.

Nevertheless, even homeowners in areas in which houses have appreciated, can be house rich, cash poor.

The banks, of course, want to lend out as much money as they can possibly do safely. They figure that 28% household income can go to service house debt including mortgage payments, property taxes, maintenance and utilities. People who incur that level of debt can have a very high net worth if they live in areas in which houses have appreciated but often have little left over for discretionary spending.

Examples of discretionary spending? Travel, weddings, buying a Tesla, adding a screened porch to your house, having large dinner parties with friends and family – all fun things.

Don’t do what the banks want you to do! Don’t go there!

Have you ever seen property taxes go down? Or maintenance costs or the cost of utilities? What if the unexpected arrival of a baby eliminates one of the income sources?

Being house rich and cash poor can be very unpleasant.

What can people who are there to to solve their problem?

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join Us