The latest BERKSHIRE HATHAWAY INC. SHAREHOLDER LETTER is available.

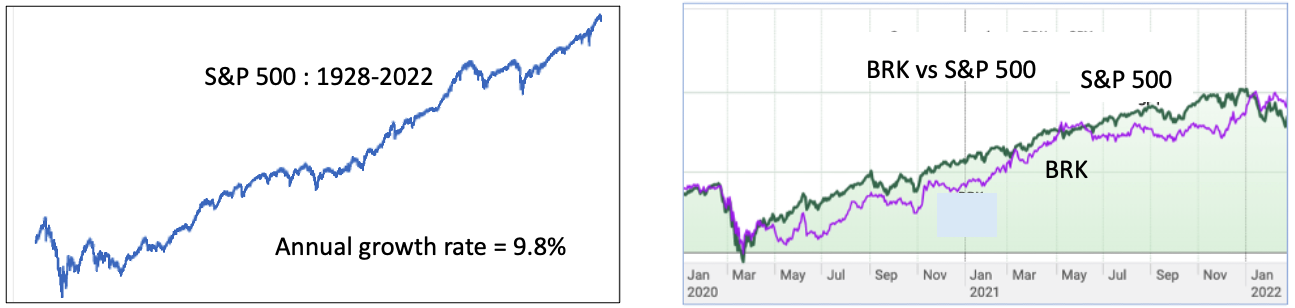

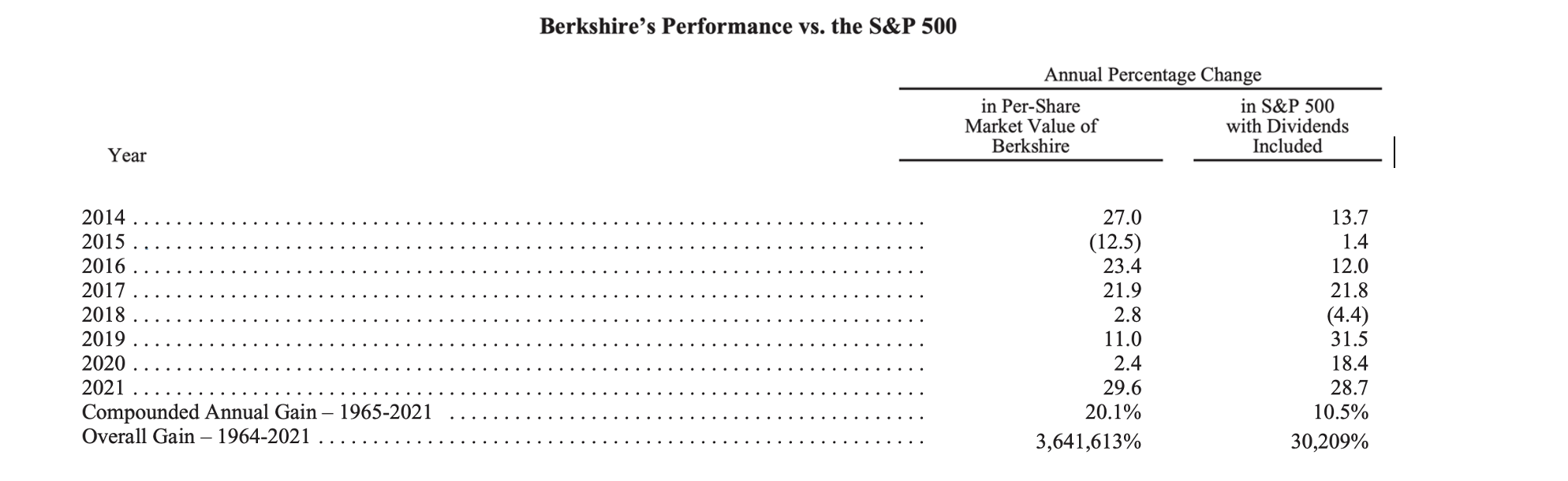

The last two lines above show the performance of BRK since 1965. Unmatched! However, since 2014, the average Per-Share Market Value of BRK has increased by 13.2% compared to the 15.39% for the S&P 500.

Buffett and Munger predicted many years ago that the day would come that they would not be able to match the S&P 500 performance. The size of the company is so big now that they cannot turn on a dime the way that they used to be able to do.

In fact, Buffett wants his estate to invest most of the money which he is leaving to his wife after he dies, into an index fund that tracks the S&P 500.

That is precisely the way that the Monday Morning Program promotes.

If it is good enough for Buffett and his heirs and successors, should it not be good enough for all investors?

With the habits of the Monday morning program, luck hardly matters.

Good luck!