First, a thank you to all who gifted a membership or a one-on-one zoom meeting to friends and relatives. We think that they make ideal gifts. Consider it.

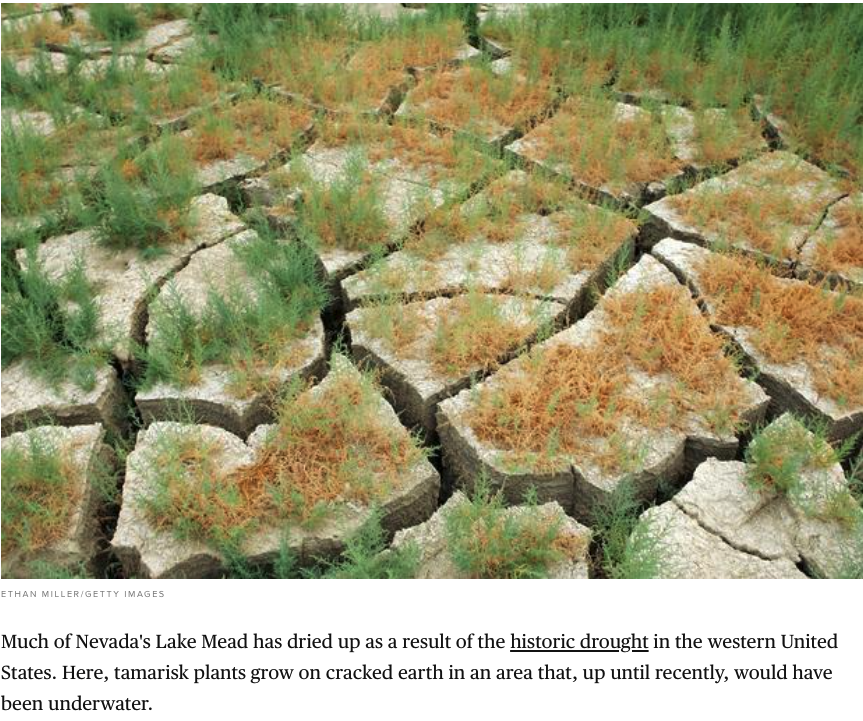

Next, our sincere gratitude to all members who took the time to respond to our Friday, June 3, survey about climate change. Time is an irreplaceable resource. We appreciate your involvement.

You can see our survey results below.

|

Do you consider that climate change risks already exist? |

|

| Yes, they do. |

46.7% |

|

No, they don’t but will develop. |

20% |

|

They already exist and will get much worse. |

33.3% |

You can you read some worthwhile comments below.

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join Us