First, a thank you to all who gifted a membership or a one-on-one zoom meeting to friends and relatives. We think that they make ideal gifts. Consider it.

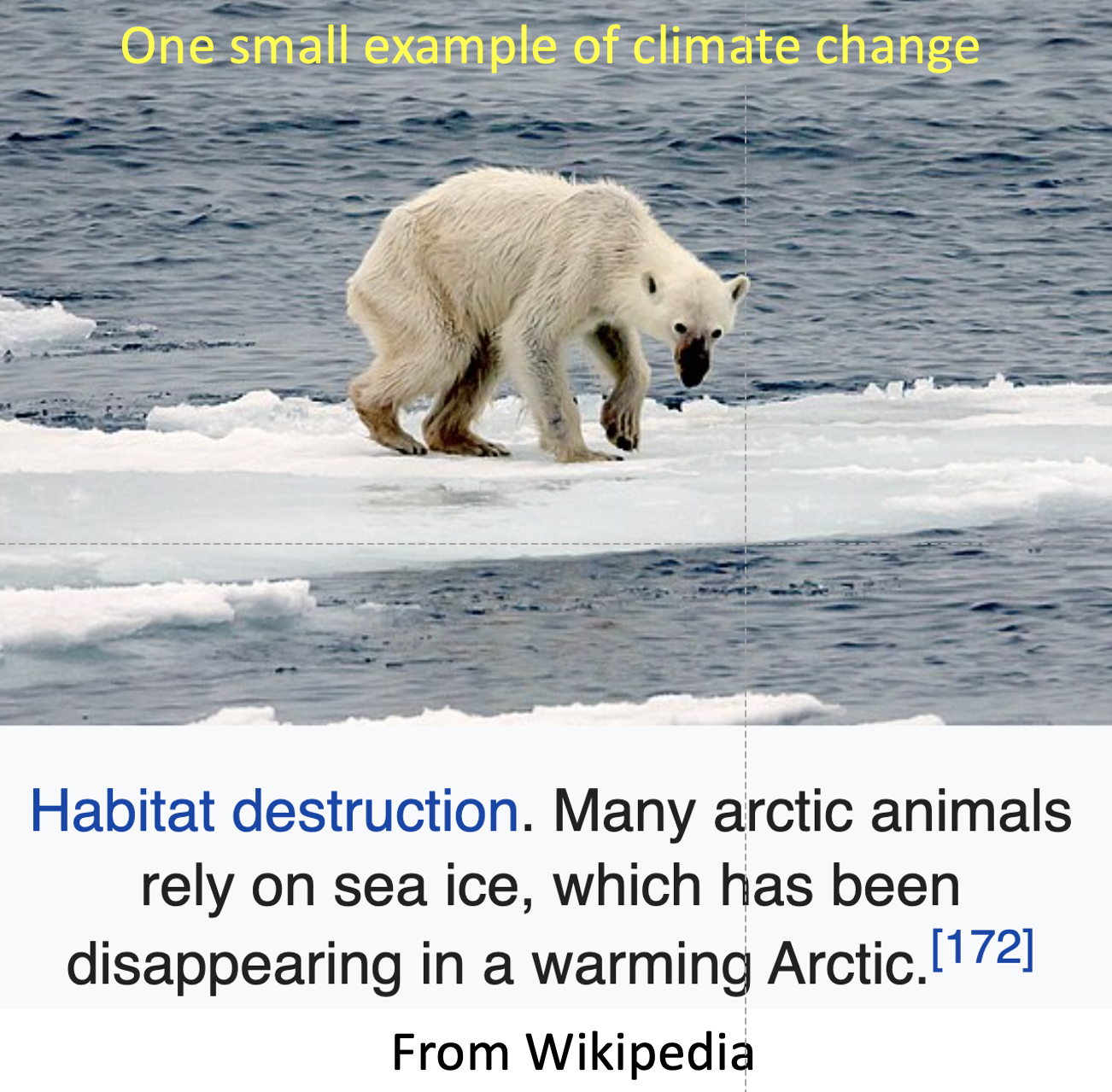

And now, our sincere gratitude to all members who took the time to respond to our Friday, September 9 survey about investing in companies that are not environmentally, socially and governance (ESG) compliant.

Time is an irreplaceable resource. We appreciate your involvement.

This is the first time that we have had 100% of our respondents agree with one of the choices offered. We are happy to see such response to the Monday Morning method of investing.

You can see our survey results below.

| How do you feel about investing in the S&P 500 given that it has non-ESG compliant companies? | |

|

The US economy has created more wealth for more people than most other economies. On the balance, it is doing more good than harm. I have no problem investing in the S&P 500. |

100%

|

|

I am getting better results investing in individual, E.S.G. compliance companies. |

0%

|

And below, you can see members’ comments.

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join Us