The Monday Morning Millionaire Program will show you how to outperform more than 90% of professionally actively managed funds, guaranteed. At the same time, over an investing lifetime, you can save a year’s income by avoiding adviser fees. Investors can do that by buying and holding a US market index-tracking exchange traded fund (ETF). For a detailed step by step description, join the Monday Morning Millionaire Program.

Step 1. Open a brokerage account.

There are many stock brokers who would be glad for your business. Adam Smith’s “unseen hand” operates among them; their services and fees are similar. Choosing one at random would hardly make a difference in the long run.

Step 2. Save and invest.

Starting early in life, deposit 10% of your annual income regularly (say monthly) and buy board lots (100 shares) of a very low-cost S&P 500 index exchange traded fund (ETF). If you start saving later in life, you will need to save a larger percentage. Donald Trump would be richer today had he taken his inheritance, invested it this way and sat in a rocking chair.

There are thousands of ETFs. The key wording here is to buy an ETF which represents the US economy such as a broadly-based index fund. Review Chapter 4 in Monday Morning Millionaire.

The best ETFs to track the S&P 500 are:

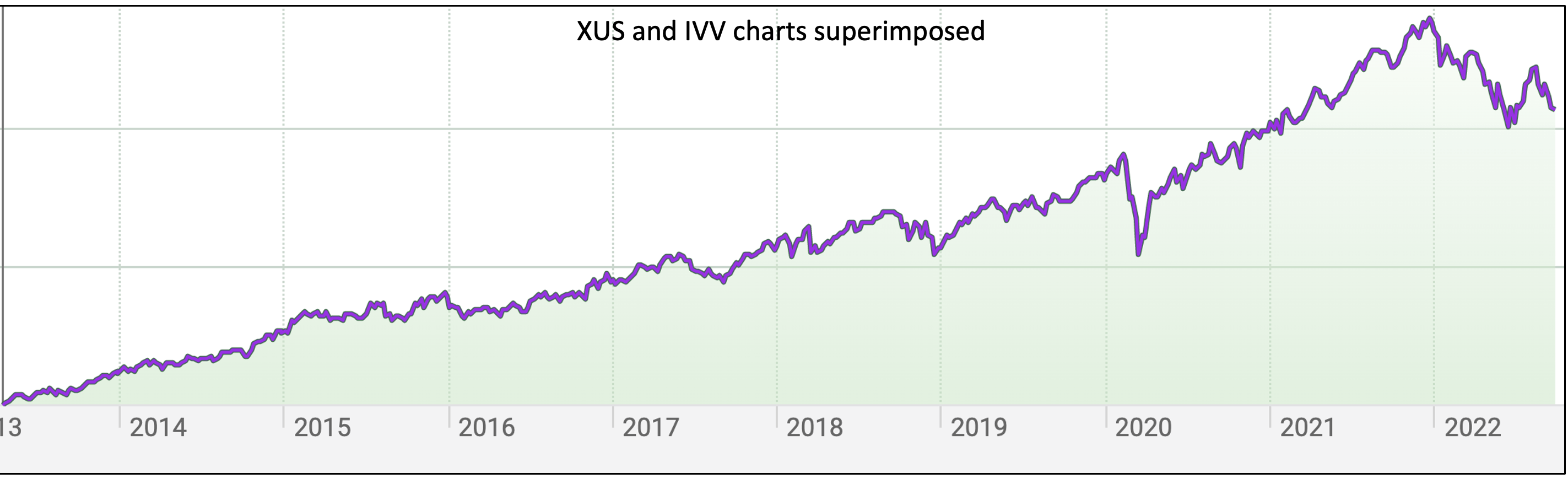

- iShares Core S&P 500 ETF (IVV)

- Vanguard S&P 500 ETF (VOO)

- SPDR S&P 500 ETF Trust (SPY)

- Schwab U.S. Large-Cap ETF (SCHX)

- iShares S&P 500 Growth ETF (IVW)

- Guggenheim S&P 500 Equal Weight ETF (symbol RSP)

Each is an excellent approximation of the U.S. economy, the strongest economy in history.

Keep buying board lots regularly. Over a working lifetime, this approach will produce a fund large enough to maintain you in comfortable retirement. Furthermore, you will be dollar cost averaging, the only guaranteed way to beat the market. Follow

https://www.investopedia.com/terms/d/dollarcostaveraging.asp

This core portfolio will allow you to outperform over 90% of professionally managed funds, guaranteed, in addition to saving you a year’s income in fees.

Divide your ETF holdings and cash savings in a ratio that is in line your risk tolerance.

A 50/50 ratio works well for most investors, however, market/cash ratios needs to be individualized.

Step 3.

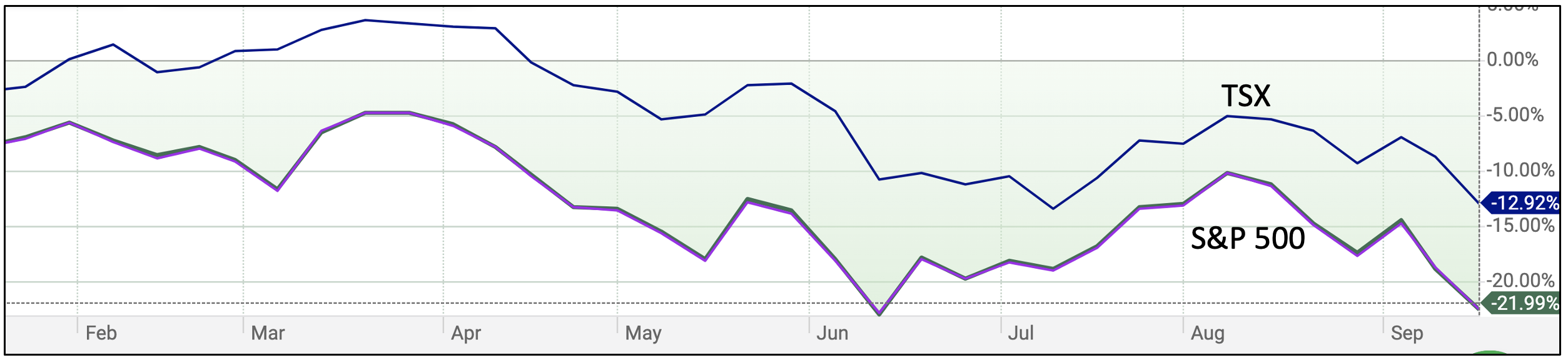

In retirement, withdraw 1% quarterly from your core portfolio or 2% semiannually or 4% annually and live happily ever after and your portfolio will likely grow. You will never run out of money but you will have to accept a smaller income during the guaranteed occasional market drops.