The title of this post is the actual title of a ten thousand-word paper by Aizhan Anarkulova et al, published in SSRN on September 22, 2022.

Blog

The case against picking stocks and our fearless, intrepid investor’s performance and plans for today, Monday, November 14

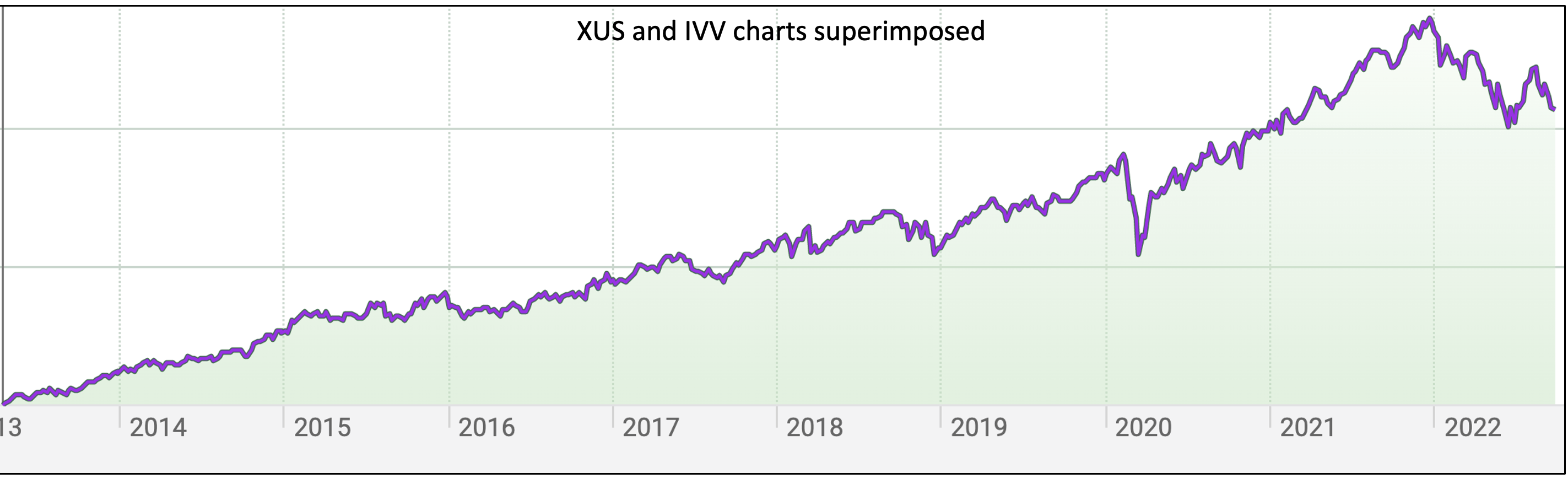

As we frequently state, historically, 1.) over the long term, 2.) properly selected US market index exchange-traded funds, 3.) held in tax-advantaged accounts, 4.) in an appropriate asset allocation, have been the investors’ best way for growing savings and are likely to remain so for many years. Examples are easy to find. Here is another one.

When Facebook went public in 2012, it earned $3.7 billion, yet the stock price fell 50% that year.

From then on, until August 2021, its shares were up 2000%!! Unmatched, unbelievable!

The stock is now down almost 75% from all-time highs, falling more than 20% last Thursday alone.

Last fall, it had a market cap of over $1 trillion. It now has a market cap of $266 billion; that is, it lost more than $800 billion in a little over a year.

Except for Apple, Microsoft, Google and Amazon, $800 billion is greater than the market cap of any stock in the S&P 500. Investors who held the S&P 500 did far better in a boring manner.

Enough said against picking individual stocks. Let us visit our fearless, intrepid investor now.

Writing just out-of-the-money covered calls on Novavax (NVAX) on Mondays, expiry dates on Fridays of the same week, our fearless, intrepid investor lost $US10,990.00 in her “fun” portfolio over one year. The loss is mainly caused by picking a stock, a no, no, as our Facebook example shows.

What she learned from that experience is to write (sell) covered calls on an exchange-traded fund representing the S&P 500, such as SPY, sufficiently out-of-the-money to earn about 1% per month or slightly more. That would significantly reduce the possibility of being assigned!

Using that approach, she is doing well.

What will she do when the NYSE opened at 9:30 AM today?

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join UsMomentum investing. The trend is our friend….until it isn’t!

The price trend of any security is more likely to continue than it is to reverse itself. Nevertheless, it will reverse itself someday. Investing in a security based on its price trend is called momentum investing. Momentum investors buy securities that have had high returns over the past year or so and sell those that have had poor returns.

With no guarantees, momentum investing can outperform the buy and hold strategy which we promote. However, it does require ongoing monitoring with the associated major time commitment.

For scholarly answers to investing questions, unbiased answers not designed to get you trading, see Social Sciences Research Network (SSRN) . It is an outstanding source of academic, evidence-based information. The SSRN economic papers are difficult for the layperson to understand, but the abstracts are manageable.

If you are interested, see what SSRN has to say about momentum investing.

Luck hardly matters with the habits of the Monday Morning Program.

Good luck!

Monday, October 31, 2022. How our fearless, intrepid investor made out last week and her plans for today

As we previously stated, our fearless, intrepid investor lost $US10,990.00 in her “fun” portfolio over one year, writing just out-of-the-money covered calls on Novavax (NVAX) on Mondays, expiry dates on Fridays of the same week.

What she learned from her NVAX experience is to write (sell) covered calls sufficiently out-of-the-money to earn about 1% per month or slightly more. That would significantly reduce the possibility of being assigned!

Using that approach, she has done well.

What will did she do when the NYSE opened at 9:30 AM today?

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join UsMonday, October 24, 2022. How our fearless, intrepid investor made out last week and her plans for today

As we previously stated, our fearless, intrepid investor lost $US10,990.00 in her “fun” portfolio over one year, writing just out-of-the-money covered calls on Novavax (NVAX) on Mondays, expiry dates on Fridays of the same week.

Mistakes are practice shots if we learn something from them. What did she learn from her NVAX experience?

Instead of writing just out-of-the-money covered calls on any security, she decided to write covered calls sufficiently out-of-the-money to earn about 1% per month or slightly more. That would significantly reduce the possibility of being assigned!

What will did she do when the NYSE opened at 9:30 AM today?

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join UsLearn the rules so you can break them. Is now a good time?

There are several dozen chess principles or rules that chess players observe. A good chess player knows the right time to ignore chess principles.

Can the same approach apply to investing?

Yes it can, and now could be the time. The Monday Morning approach to investing equals the US market at all times. Throughout a market cycle (peak to trough to peak) very few investors, including professionals, can equal the US market. The average investor trails the market by 40%.

Monday Morning investors have six habits.

- Save.

- Do it yourself.

- Buy the American market as a whole by investing in an exchange-traded fund that tracks the S&P 500. (No stock picking.)

- Buy and hold. (No attempts at market timing.)

- Rebalance to your asset allocation when market movement in either direction throws it off.

- Avoid complexity.

Some members have a “fun” portfolio. What do they do in their “fun” portfolios? They pick individual stocks, trade actively, invest in penny stocks, day trade, trade in derivatives and generally behave in ways that make Wall Street happy.

Nobody needs a “fun” portfolio. However, something worthwhile occasionally comes up in a “fun” portfolio that can be done in a core portfolio, to some extent.

We could be there now.

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join UsDo you play games like chess, bridge, poker or checkers? October 7, 2022 survey results

Our sincere thank you to all who gifted a membership or a one-on-one zoom meeting to friends and relatives. We think that they make ideal gifts. Consider it.

Also, thank you to all members who took the time to respond to our Friday, October 7 survey about games and our apologies for the late report on the outcome.

You can see our survey results below.

|

Do you play games like chess, bridge, poker or checkers? |

|

|

I play some of these games regularly. |

20.7% |

|

I play some of these games occasionally. |

48.3% |

|

I never play any of these games. |

31.0% |

You can you read some worthwhile comments below.

Monday, October 17, 2022. How our fearless, intrepid investor made out last week and her plans for today

Writing (selling) just out-of-the-money covered calls on any security generates the largest percentage return if the expiry date is close, say, a week away or in the same week. It also results in having a 50% chance of being assigned, that is, having to sell the security below market price. Then, to stay in the game, investors are required to buy high. Our approach to investing is to sell high!

Our fearless, intrepid investor lost $US10,990.00 in her “fun” portfolio over one year, writing just out-of-the-money covered calls on Novavax (NVAX) on Mondays, expiry dates on Fridays of the same week.

Mistakes are practice shots if we learn something from them. What did she learn from her NVAX experience?

Instead of writing just out-of-the-money covered calls on any security, she decided to write covered calls sufficiently out-of-the-money to earn about 1% per month or slightly more. That would significantly reduce the possibility of being assigned!

For the last few weeks, she has been doing that with Intuitive Surgical (ISRG) with good results. ISRG has dropped by a far greater extent than the premium income that selling covered calls on the security has produced, but intelligent investors ignore short-term fluctuations. She likes ISRG and is happy to hold long-term.

What will did she do when the NYSE opened at 9:30 AM today?

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join UsListening to talking heads is a waste of time. Most of the time.

There are 18 hours of talking heads discussing the stock market every day! (Not to be confused with American new wave band using that name.) Investors would not miss out on anything helpful if they spent no time at all, listening to talking heads.

Despite that attitude, I have become a talking head, hoping to state something worthwhile.

Follow https://youtu.be/ay3B3XCcqkw to see yesterday’s show. Stop looking as soon as you find it boring.

Luck hardly matters with the habits of that Monday Morning Program.

Good luck!

Tuesday, October 11, 2022. How our fearless, intrepid investor made out recently and what she did yesterday

Writing just out-of-the-money covered calls on Novavax (NVAX) every Monday, expiry date on Friday of the same week, our fearless, intrepid investor lost $US10,990.00 in her “fun” portfolio over the course of about one year. She bought 1,100 shares at $US300 a share for a total of $US330,000.00. Last Friday, September 30, NVAX closed at $US18.20! Her shares would have had a market value of$US20,020.00 ($US18.20 times 1,100) but she got out earlier plus she did earn something from the weekly premium income that she received reducing her losses to the $US10,990.00 mentioned above.

Mistakes are practice shots if we learn something from them. What did she learn from her NVAX experience?

Instead of writing just out-of-the-money covered calls on any security, she decided to write (sell) covered calls sufficiently out-of-the-money to earn about 1% per month or slightly more. That would significantly reduce the possibility of being assigned!

She likes Intuitive Surgical (ISRG), so she bought 300 shares at $243.7592 per share for a total of $US73,127.76. ISRG will continue to generate premium income even when it declines in the short term. In. The. Short. Term.

Indeed, ISRG has dropped by a far greater extent than the premium income that selling covered calls on the security has produced.

Intelligent investors ignore short-term fluctuations. She likes ISRG and is happy to hold long-term.

What will did she do when the NYSE opened at 9:30 AM yesterday?

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join Us