One of our followers recently stated that our posts have a lot of redundant content. They don’t bring something new that isn’t already on the site but just more of the same.

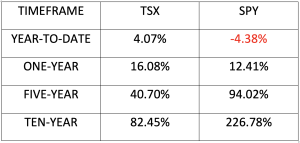

The reason why that is true is that our evidence-based message is as simple as it is effective. It encourages the development of the six habits which show that historically, 1.) over the long term, 2.) properly selected US market index exchange-traded funds, 3.) held in tax-advantaged accounts, 4.) in an appropriate asset allocation, have been the investors’ best way for growing savings and are likely to remain so for many years.

Investing in US market index exchange-traded funds instead of picking stocks is part of the reason for that. Stock pickers have a great deal to talk about. To listen to Talking Heads or to read what is published in any one day would take more than a month.

And the result?

Over the last 20 years, the average stock-picking retail investor earned 4.25% annually. During that time, the S&P 500 averaged 6.06%, inflation-adjusted. The average stock-picker is 42.6% behind!

Interestingly, after fees, about 95% of professional money managers, stock-pickers all, failed to equal the S&P 500.

All of them think that they are above average – the superiority bias.

So, how can investors equal the S&P 500?

We can teach that to a high-school student.

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join Us