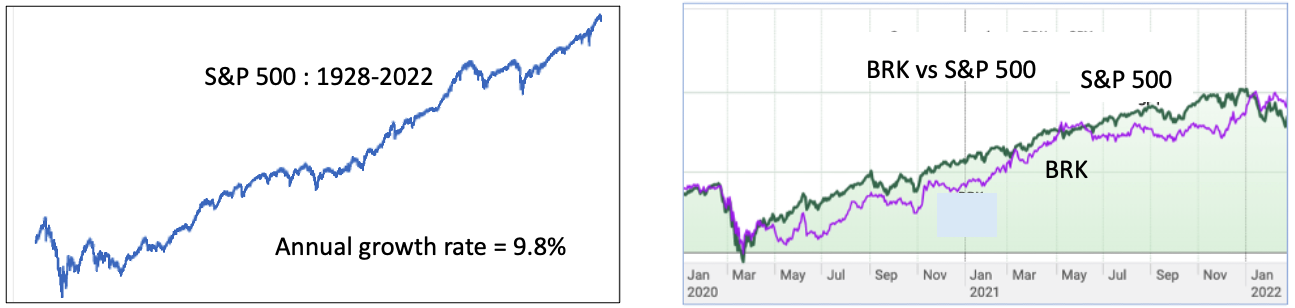

On January 3, the first trading day of this year, the S&P 500 reached an all-time high. From then on, it has been in a steady decline, with some fluctuations, even briefly reaching bear market territory recently. (A decline of 20% or more)

If you search for how to deal with bear markets, you will see a huge number of hits. The bottom line on most of these is that investors need to connect with an adviser.

We need advisers in many areas – taxation, wills, incorporation and on and on. The list is long. Accountants, lawyers, other advisers typically charge $300 an hour, minimum. Most of the time, the money that they save us exceeds their fees.

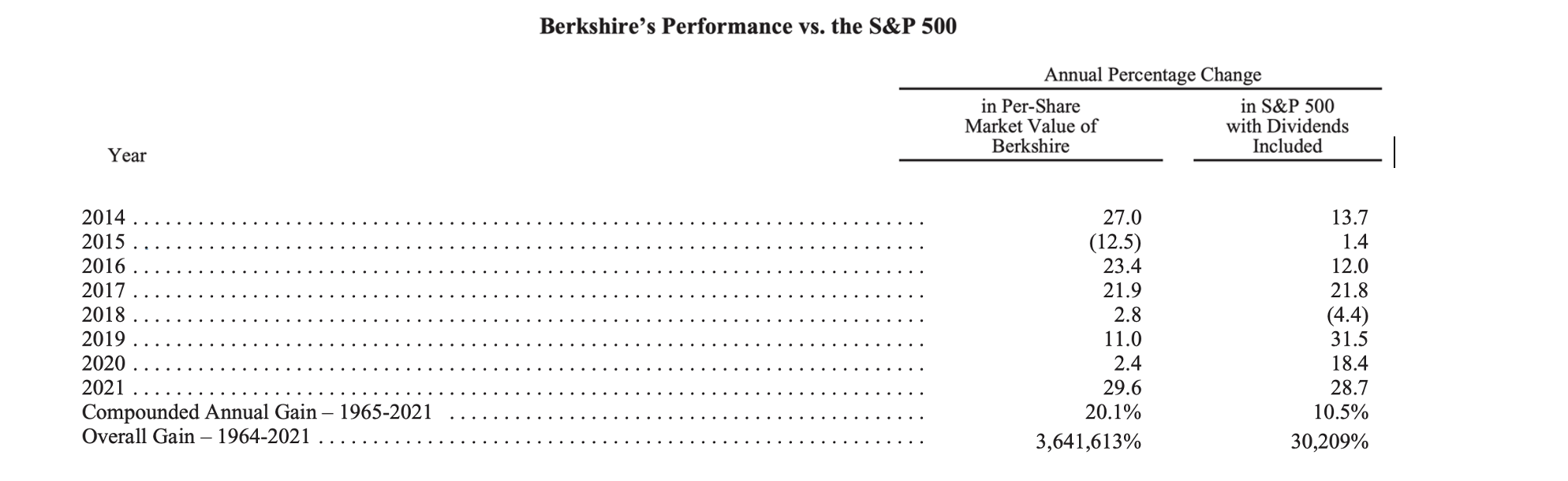

But when it comes to investing, almost no advisor can equal the S&P 500 over an extended period after fees. In 15 minutes or less, we can teach a high school student how to equal the S&P 500. Do it yourself. (Habit number two)

What about bull markets?

Like love and marriage, horse and carriage, you can’t have one without the other. Over an extended period, the S&P 500 has returned about 10% annually, bear markets notwithstanding.

There are many hedging strategies. Buying options, using managed futures, trend-following, alternative investment strategies are examples. Here too, the list is long. None is reliable under all conditions.

Well, people can ask what is reliable under all conditions? The Monday Morning Method is. Absolutely!

And what is the Monday Morning Method?

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join Us