Your answer to holding only the S&P 500 index in your portfolio was good. Thanks Milan.

When being bombarded with financial services marketing the average investor needs to be reminded of the MMM philosophy.

Your answer to holding only the S&P 500 index in your portfolio was good. Thanks Milan.

When being bombarded with financial services marketing the average investor needs to be reminded of the MMM philosophy.

From Danny Rain DDS, Sudbury ON, Canada

When you place an order for any security before the market opens on Monday mornings, is it a “Market or Limit” order?

Market orders are filled immediately at the ask level of the bid/ask price when the stock market opens.

Depending on what you request (the number of shares, the dollar amount you want to buy or sell at, the length of time for your order execution), limit orders can take a very long time to fill if they get filled at all. With thinly traded companies, the bid/ask spread, one of your costs, whether you are buying or selling, can be very large.

With heavily traded companies, for example NVAX or SPY, market orders are safe. The job gets done allowing you to focus on other things.

Ben Carlson

On June 3, 2022, from Lance McIntosh DDS, Prescott ON, Canada

You provided a link to Ben Carlson’s blog last year and I have been enjoying his site and podcasts since then. Thanks for that.

The link below will take you to his latest post. It challenges the idea of holding only the S&P 500 index in your portfolio and makes a case for more diversification. Thoughts?

https://awealthofcommonsense.com/2022/06/what-if-this-is-a-big-regime-shift-in-the-markets/

Our answer

Investors can get a lot of useful information from Ben Carlson’s blogs.

Keep in mind that Carlson’s ultimate objective is to get clients whose portfolios his company, Wealth Simple, can manage.

Without question, there is a legitimate place for professional money management for investors not interested in doing it themselves, for widows and orphans, for those who are afraid to look after a large sum they might get from selling a business, and so on.

Investors don’t need to look very far to find a great many posts dealing with the negative side of passive index investing. All of these posts are designed to get investors to connect with a manager.

SPIVA has convincingly shown that over 90% of actively managed funds have underperformed the S&P 500 over a market cycle.

Warren Buffett, one of the most successful investors ever, wants the money that he is leaving to his widow to be invested in a passive index fund and cash or near-cash.

If that approach to investing is good enough f0r Buffett, should it not be good enough for any of us?

With the habits of the Monday Morning Program, luck hardly matters.

Good luck!

Timothy A. Brown, FRI

CEO www.roicorp.com

One of my clients asked me the other day if he thought my traditional brokerage service would be under threat because of all the developments in technology. Just look at travel agents. Who really uses them anymore?

How about the financial services industry? Everybody could buy and sell their own stocks using a do-it- yourself direct investment account. Why would the traditional full-service, full-fee financial advisor/stock trader stay in business?

Circling back to my industry and using the residential real estate as a close parallel, why is it that traditional real estate agents continue to earn 5% of the sale of over 97% of all Canadian homes? There are all kinds of self-serve websites. With all the advent in technology and social media, it is quite easy to market a home and it has been a seller’s market for several years, so why are people still paying 5% to have their house sold?

My industry is very secure and not necessarily easily disrupted by technology, but of course I am biased, and I am a traditionalist, and I am obviously going to defend my company, our fees, and our future business cycle.

But the purpose of this article is to talk about the financial services industry. When they produce exceptional returns, I would be more than happy to pay them their traditional percentage to manage my money or buy and sell my stocks and bonds and other entities.

The problem is that all statistics show that the best investment managers rarely, if ever, beat the indexes. The most reliable index is the Standard & Poor’s 500 and that can be easily bought and sold via exchange traded funds, which any individual investor at any age can buy within minutes. No advice is required to buy the top 500 companies in the United States of America. None!

So why do we pay the players of this industry when the advice of the experts produces less than what we can achieve on our own? Why do they stay in business? Why do we continue to pay them? They do nothing for us and in fact, they are doing more damage to our financial portfolios than good. It is habit and fear. Nothing more, nothing less.

If a real estate agent sells your house for far more than you expected and you are thrilled, the 5% does not mean anything any longer.

If a dental practice broker sells your practice for a record amount, the 10% charged would appear nominal (and it is tax deductible) and you should be happy.

While no one in any brokerage can guarantee a result, such as real estate, stocks and bonds or my industry, I can tell you that if somebody is creating value for you, pay their fees happily.

If somebody is doing a disservice to you and costing you money, I do not understand why you continue to pay them.

First, a thank you to all who gifted a membership or a one-on-one zoom meeting to friends and relatives. We think that they make ideal gifts. Consider it.

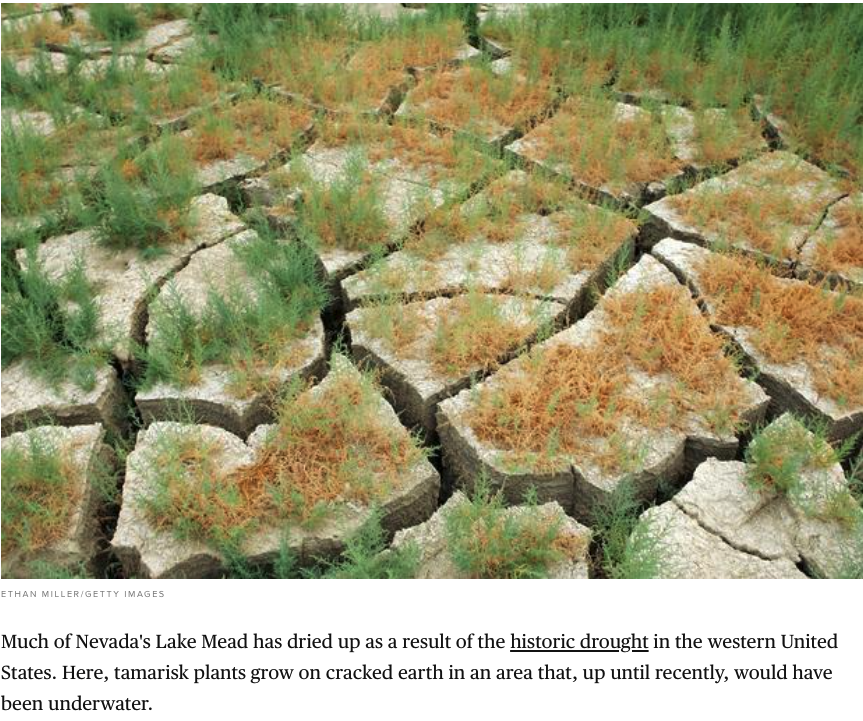

Next, our sincere gratitude to all members who took the time to respond to our Friday, June 3, survey about climate change. Time is an irreplaceable resource. We appreciate your involvement.

You can see our survey results below.

|

Do you consider that climate change risks already exist? |

|

| Yes, they do. |

46.7% |

|

No, they don’t but will develop. |

20% |

|

They already exist and will get much worse. |

33.3% |

You can you read some worthwhile comments below.

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join Us

It is no secret that I am calendar-challenged. Today’s post went out yesterday. However…

… having had a chance to think more about what to do when the market opens today at 9:30 AM, our fearless, intrepid investor has come up with additional potential benefits. I will communicate these to you here.

She has been writing covered calls on Novavax (NVAX) on Mondays with expiry dates on Fridays of the same week.

Last Friday, June 3, NVAX closed at $44.76. That is close to the low end of its 52-week range. By buying more, she would lower her average per-share cost and be in a position to write more covered calls.

Questions:

Where will the money come from if she were to buy more NVAX shares? After all, this is her “fun” portfolio and should not exceed 10% of her overall stock market investments.

What is the worst that can happen?

What is the best that can happen?

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join Us