Greetings everyone,

First, a sincere thanks to all of you who gifted memberships and one-hour sessions to friends and relatives. A more useful gift would be difficult to find.

Next, we think all of you who took the time to respond to our surveys.

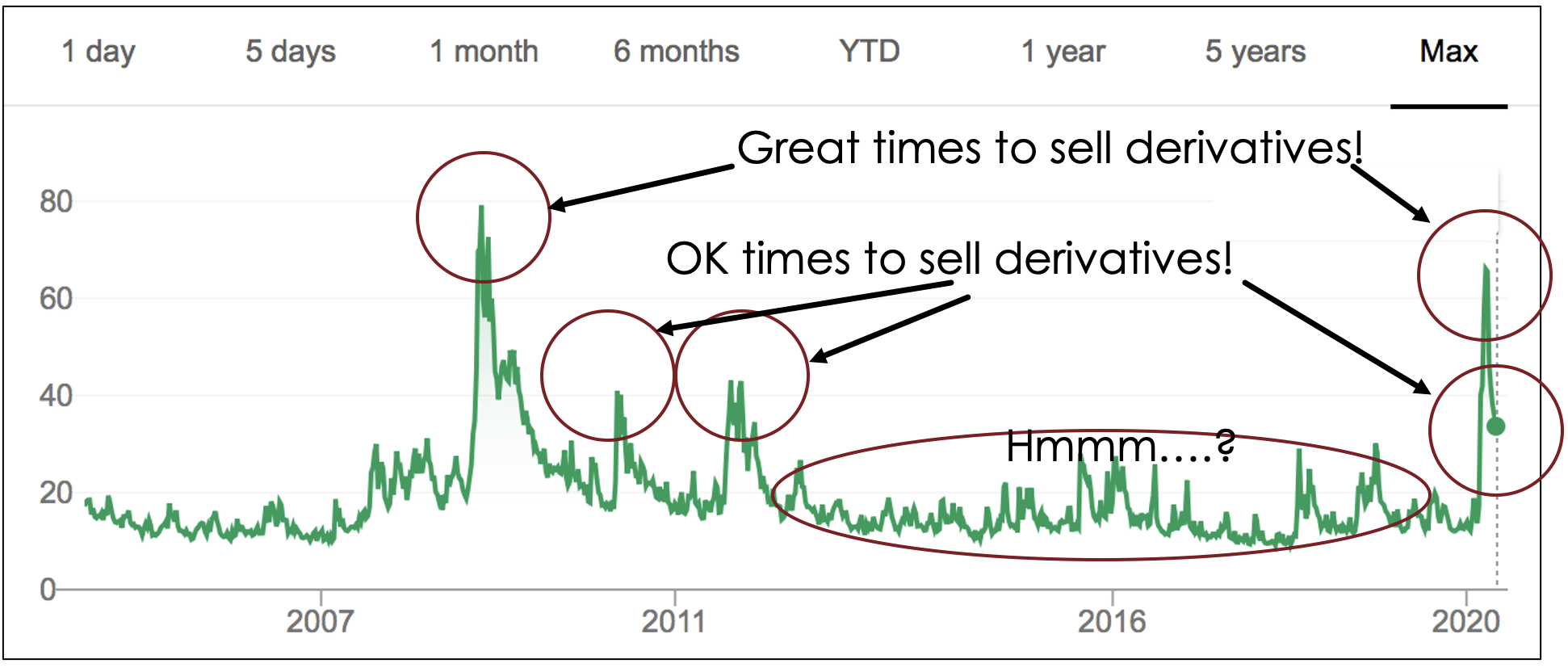

In May, 2021, we asked our members and subscribers to what extent they were interested in derivatives (calls and puts).

We conducted a similar survey recently. You can see the results below. They are almost identical to the May, 2021 survey.

| Choice |

May, 2021

Percentage

|

June, 2022

Percentage

|

| I regularly write calls and puts. |

31.6%

|

28.6%

|

| I am interested in calls and puts but need to know more. |

52.6%

|

53.6%

|

| I am not interested in calls and puts. |

7.9%

|

7.1%

|

| I used to write calls and puts but no longer do so. |

7.9%

|

10.7%

|

Below, you can see our response to relevant comments. ___________________________________

Comment

Writing calls and puts should be done in a “fun” portfolio only.

Our response

We agree. Occasionally, with luck, we will stumble across a safe, worthwhile derivatives experience in our “fun” portfolio. We can then do some of that in our core portfolio.

___________________________________

Comment

More about on step by step of when and how to do it. More homework based on do-it-yourself approach.

Our response

We will have something useful and to the point on most Mondays.

___________________________________

Comment

I have written calls and puts but have difficulty understanding how productive they are compared to if they were not used.

Our response

As we frequently state, luck hardly matters with the habits of the Monday Morning Program. Except on rare occasions, writing derivatives does require luck.

Investors with a long-term mindset can do very well without writing derivatives.

___________________________________

Comment

Still not sure how to make money using covered calls. Would like to learn how one does it.

Our response

We will publish condensed versions of Social Sciences Research Network articles dealing with this issue.

___________________________________

Comment

Who made you think of this survey?

Our response

Former ODA president (1970 – 1971) Ivan Hrabowsky made me think of it. On 2022-08-02 Ivan will be 91 years old. He likes stimulating discussion.

___________________________________

Comment

I am interested in the process, but as I have said, ‘I am a poor gambler’.

Our response

Our posts on this subject will require minimal gambling.

___________________________________

Comment

These derivatives add to returns if used prudently.

Our response

We fully agree with your comments. Acting prudently applies to all investing. Investing of any kind always involves risks, but if the benefits exceed the risks, we will come out ahead most of the time, but not all the time.

___________________________________

Comment

Sure, you always make money when you sell calls. But if the security is called away and you are staying with the same security (e.g. SPY) you will have to buy the shares back at a higher price before selling calls again. If the premium received does not cover the difference between the old share and new share cost there is no profit made in this transaction. This can happen frequently. You are trying to predict the market in a short time interval (weekly) which is akin to gambling.

Our response

Your comments are spot on!

We will review evidence–based methods to lower (but not eliminate) all risk.

___________________________________