The most important thing to learn from our fearless, intrepid investor’s loss of $US10,990.00 in her “fun” portfolio over a year is not to write covered calls on individual securities. She sold just out-of-the-money covered calls on Novavax (NVAX) on Mondays, expiry dates on Fridays of the same week. NVAX declined to a far greater extent than the premium income she received for that transaction.

It is far better to sell covered calls on the American market as a whole by using an exchange-traded fund (ETF) that tracks the S&P 500. SPY is the best. It is the largest, oldest, and most heavily traded US ETF. It has the narrowest bid/ask spread, one of investors’ expenses that most tend to ignore.

Also, writing (selling) covered calls sufficiently out-of-the-money to earn about 1% per month or slightly more, significantly reduces the possibility of being assigned while yielding a decent return.

What will she do today when the NYSE opens at 9:30 AM?

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join UsCorrection re “Freedom from Ownership”

An article sent to our subscribers on January 20, titled “Freedom from Ownership”, attracted many viewers. It was improperly credited as being authored by Timothy Brown.

The author of the article is Dr. Drew Markham [drew@roicorp.com], with a comment from Timothy at the end of the article.

I apologize.

Milan

Monday, January 23, 2023. How our fearless, intrepid investor made out last week and her plans for today

In previous posts, we mentioned that our fearless, intrepid investor lost $US10,990.00 in her “fun” portfolio over one year by writing (selling) just out-of-the-money covered calls on Novavax (NVAX) on Mondays, expiry dates on Fridays of the same week. How much fun is that?

She ignored habit number three, which recommends that investors buy the American market and not pick individual stocks. Investors can buy the American market by acquiring an exchange-traded fund (ETF) that tracks the S&P 500.

SPY is the best. It is the largest, oldest, and most heavily traded US ETF. It has the narrowest bid/ask spread, one of investors’ expenses that most tend to ignore.

All risk in selling covered calls comes from the market movement of the underlying security. When she owned NVAX, it dropped significantly more than the premium income she received. So, no more writing covered calls on individual securities for her.

Further, she decided to write (sell) covered calls sufficiently out-of-the-money to earn about 1% per month or slightly more. That would significantly reduce the possibility of being assigned while yielding a decent return!

What did she do last Tuesday, January 17, 2023? (Monday, January 16, NYSE was closed for Martin Luther King Jr. Day.)

She sold covered calls on SPY at a strike price of $US5.00 out-of-the-money, that is, $US404.00, expiry date Friday, January 20 (SPY C 20JAN23 404.00 US). She earned $US0.83 per share – much less than the previous week’s premium income which was $US1.22 per share. Nevertheless, it still is guaranteed, immediate and decent.

What will she do today when the NYSE opens at 9:30 AM?

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join UsFreedom from Ownership

Greetings everyone,

The post below, which Timothy Brown wrote, is intended for dentists but it would apply to most business people. It will make you think. Enjoy.

Milan

_________________________________________________________________________________

Freedom from Ownership – how one dentist sold everything to see the world!

As the hull crashed down for the third time, we realized that this was not going to be an ordinary boat trip. Heavy gales across Tasmania the day before had resulted in 4 meter swells and we were headed straight into them. Ginger tablets had been handed out in anticipation of the rough seas, but the very experienced captain reassured everyone that ‘this was nothing’. We forged onwards in our floor length waterproof coats towards the beginning of the Southern Ocean (with nothing but open water until Antarctica), and I was struck at how life often leads us down paths that we never could have imagined. While the other two tour boats had turned around for calmer waters, we continued (uncomfortably) into what felt like the full magnificent force of Mother Nature.

From this excursion at the ‘bottom of the world’, to living overseas, to being the only two people spending an afternoon with elephants at a sanctuary in Thailand, to celebrating my 50th birthday walking the West Highland way in Scotland, the past two and a half years have been filled with life changing experiences and……

Freedom.

Don’t get me wrong – I loved being a dentist, but when I received an eye-opening (yet very treatable) diagnosis five years ago, it was thrust upon me to make decisions for the benefit of my long-term health and the well-being of my family. Proper planning gave me the option to continue practicing as I was, modify my professional and personal lifestyle, or look very carefully at my bigger picture and realize that the pressure of even pre-pandemic dentistry was not agreeing with me.

I did receive a very useful critical illness insurance payout, but that did not impact the final decision. What made the biggest difference was a full understanding of what my biggest asset was worth. Shortly after paying off the practice (which was a magical day!), and at the behest of my accountant, I engaged ROI Corp. to perform an appraisal as a means of long-term financial planning. Tim Brown even stopped at the practice on his way north and gave his initial assessment. In my mind, I had a rough idea of the practice value based on the purchase price ten years earlier, consistent growth, and some rough guidelines for practices a couple of hours outside of the GTA. I couldn’t have been more wrong. The practice was appraised at double my high-end estimate, and the information provided tremendous insight into the operating efficiency (or lack thereof). Even better, a few simple changes added more than six figures to the total.

I also considered that the practice itself was a large source of capital, but not easily accessible. For years, my accountant had sung the praises of other clients who were funding private mortgages and enjoying a consistent return (in the form of monthly passive income) of 7-10%. The details of that can be saved for another article, but ultimately after plenty of thought, my wife and I chose to liquidate our assets, greatly simplify our lives, and move overseas to see the world. With greatly reduced expenses, almost all of our income was disposable which allowed for frequent travel at a variety of ‘star’ levels. Having recently returned to Canada for some new challenges, we are still enjoying a lifetime of memories (many photographs to organize) and a wealth of world experience garnered from stepping out of our collective comfort zone. Now getting back to the concept of freedom – this can mean a lot of different things. I don’t begin to suggest that world travel is the only form of freedom a dentist might seek – it could be continuing to practice without the pressure of managing the office, or it could be picking up a new hobby, or diving into an existing one. Whatever the dream might be, it is probably more attainable than you realize. Relying only on the passive income to fund our new lifestyle, two plus years overseas visiting more than 30 countries and a 9-week trip around the world, had a negligible impact on our net worth (down no more than 3%). Information is power!

In Closing, Timothy A. Brown, CEO of ROI Corporation adds this:

I have met and spoken with many dentists who, after selling, had this to say: “I wish I had done it sooner.”

A common thread is that they held on too long. Why?

- Their Ego told them to be a responsible owner and to be a success.

- Their advisory circle told them to ride out the lows and to be a winner!

- Their finances held many to the daily grind.

- They could not face the loss of control over their income.

This list goes on… Just ask Drew Markham. He sold young, travelled and his story should reach you if you feel any stress or anxiety from ownership.

Freedom comes at a price – but Freedom need not be expensive!

Tuesday, January 17, 2023. How our fearless, intrepid investor made out last week and her plans for today

Yesterday, Monday, January 16, was a New York Stock Exchange holiday. Hence we are reporting on Tuesday this week.

In previous posts, we mentioned that our fearless, intrepid investor lost $US10,990.00 in her “fun” portfolio over one year by writing (selling) just out-of-the-money covered calls on Novavax (NVAX) on Mondays, expiry dates on Fridays of the same week. How much fun is that?

She ignored habit number three, which recommends that investors buy the American market and not pick individual stocks. Investors can buy the American market by acquiring an exchange-traded fund (ETF) that tracks the S&P 500.

There are more ETFs now than there are individual securities, but only half a dozen or so track the S&P 500. SPY is the best. It is the largest, oldest, and most heavily traded US ETF. It has the narrowest bid/ask spread, one of investors’ expenses that most tend to ignore.

All risk in selling covered calls comes from the market movement of the underlying security. When she owned NVAX, it dropped to a greater, far greater, extent than the premium income derived from selling covered calls on the security. So, no more writing covered calls on individual securities for her.

Further, she decided to write (sell) covered calls sufficiently out-of-the-money to earn about 1% per month or slightly more. That would significantly reduce the possibility of being assigned while yielding a decent return!

What did she do last Monday, January 9, 2023?

She sold covered calls on SPY at $8.00 out-of-the-money, expiry date Friday, January 13, (CALL-100 SPY’23 13JA@402.

SPY rose by just under $8.00 last week, giving her a decent, safe return.

What will she do today when the NYSE opens at 9:30 AM?

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join UsMonday, January 9, 2023. How our fearless, intrepid investor made out last week and her plans for today

In previous posts, we mentioned that our fearless, intrepid investor lost $US10,990.00 in her “fun” portfolio over one year by writing (selling) just out-of-the-money covered calls on Novavax (NVAX) on Mondays, expiry dates on Fridays of the same week. How much fun is that?

She ignored habit number three, which recommends that investors buy the American market as a whole and not pick individual stocks. Investors can buy the American market as a whole by acquiring an exchange-traded fund (ETF) that tracks the S&P 500.

There are more ETFs now than there are individual securities, but only half a dozen or so track the S&P 500. SPY is the best. It is the largest, oldest, and most heavily traded US ETF. It has the narrowest bid/ask spread, one of investors’ expenses that most tend to ignore.

All risk in selling covered calls comes from the market movement of the underlying security. When she owned NVAX, it dropped to a greater, far greater, extent than the premium income derived from selling covered calls on the security. So, no more writing covered calls on individual securities for her.

Further, she decided to write (sell) covered calls sufficiently out-of-the-money to earn about 1% per month or slightly more. That would significantly reduce the possibility of being assigned while yielding a decent return!

What did she do last Monday?

She sold covered calls on SPY at $8.00 out-of-the-money, expiry date Friday, January 6 (SPY C 06JAN23 390.00)

SPY rose by just under $8.00 last week, giving her a decent return.

What will she do today when the markets open at 9:30 AM?

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join UsRejoice! The market is down! Bargain territory! V2

On September 2 of this year, we sent out the post you see below. Since that time, the market has fallen further. The material is worth reviewing.

Considering that the money that you will need in the next few years does not belong in the market, if you have not bought into this bargain territory, think about doing so now.

________________________________________________________________________

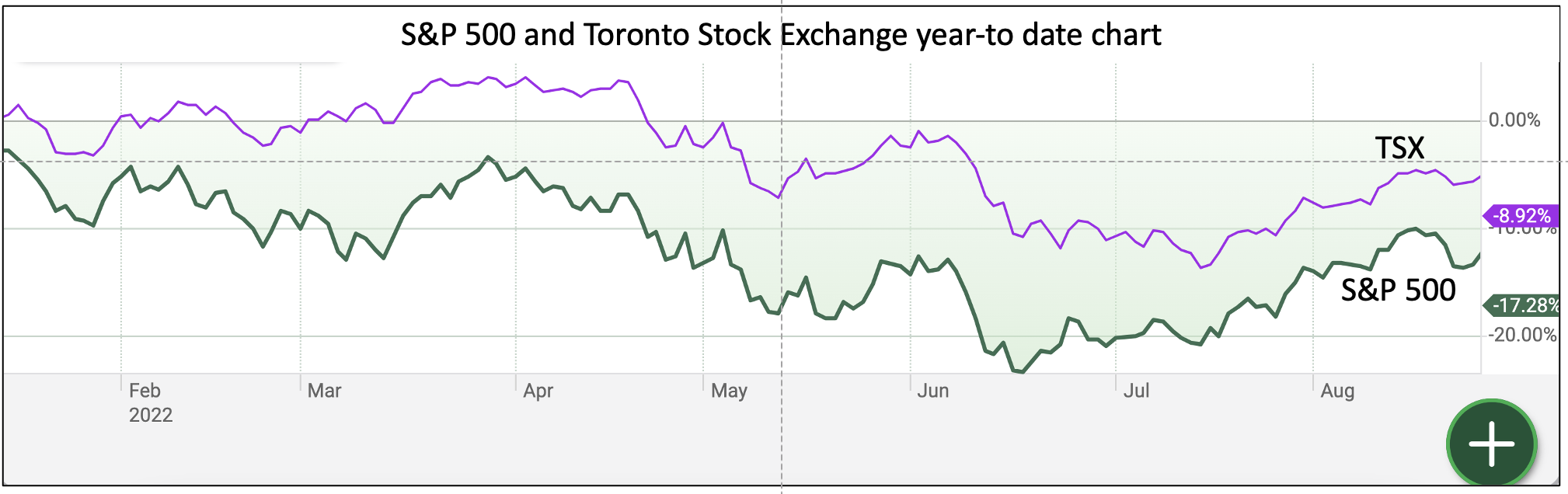

The S&P 500 is down over 17% year-to-date. Bargain territory! If you have not re-balanced your core portfolio to take advantage of the bargain, consider doing so.

The Muppets are running for the doors. The same people who look for bargains when buying their groceries or clothes for the children or airplane tickets or looking for parking spots are ignoring this bargain.

Muppets (stupid and ineffectual people)? The second largest investment bank, Goldman Sachs, uses the term to describe its clients.

From Greg Smith’s Why I Am Leaving Goldman Sachs: “I attend derivatives sales meetings where not one single minute is spent asking questions about how we can help clients. It’s purely about how we can make the most possible money off of them.”

Investment banks are not our friends. We need to be aware of that even though we do need them to execute our buy/sell orders.

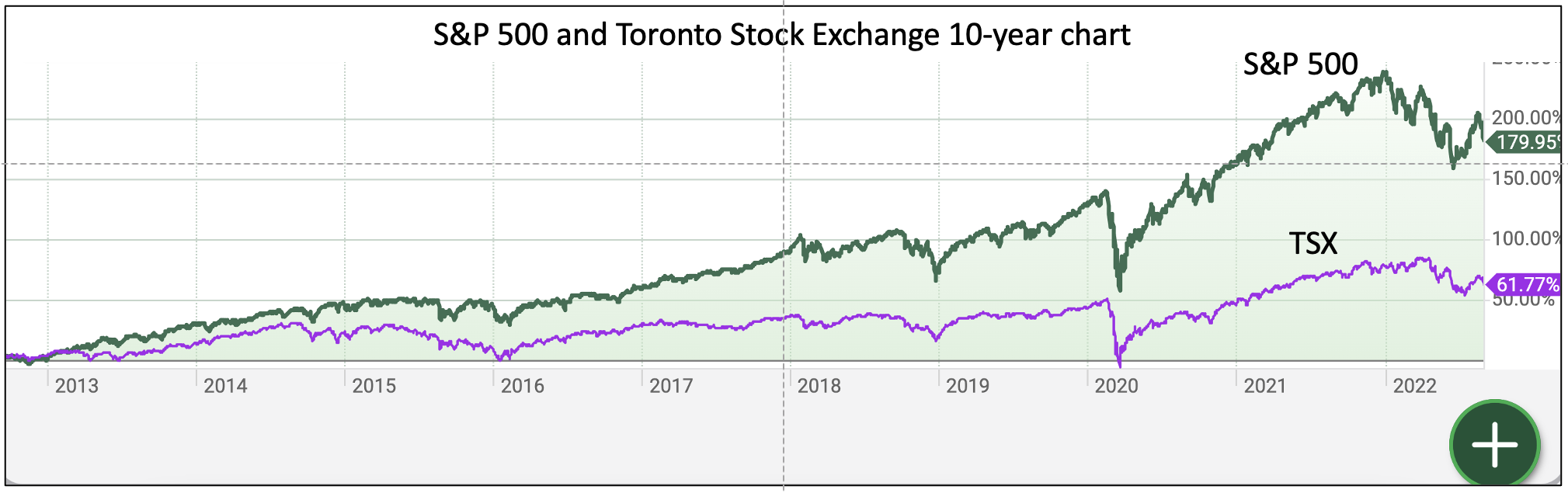

Don’t be fooled by the fact that year-to-date, the Toronto Stock exchange has declined less than the S&P 500. Intelligent investors think long-term. Note the 10-year chart below.

With the habits of the Monday Morning Program, luck hardly matters. Good luck!

Season’s Greetings

Greetings to all!

As 2022 comes to a close, Rosi and I send you our best wishes for the season and for health, happiness and serenity for 2023 and on and on.

Milan

.

Tuesday, December 13, 2022. How our fearless, intrepid investor made out last week and what she did yesterday

We previously stated that writing (selling) just out-of-the-money covered calls on Novavax (NVAX) on Mondays, expiry dates on Fridays of the same week, our fearless, intrepid investor lost $US10,990.00 in her “fun” portfolio over one year.

The risk in selling covered calls entirely comes from the market movement of the underlying security. When she owned NVAX, it dropped to a greater, far greater, extent than the premium income derived from selling covered calls on the security.

What did she learn from that experience?

Two things!

First, pay attention to habit number three, which states buy the American market as a whole and do not pick stocks.

Secondly, she learned to write (sell) covered calls sufficiently out-of-the-money to earn about 1% per month or slightly more. That would significantly reduce the possibility of being assigned!

What did she do when the NYSE opened at 9:30 AM yesterday?

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join UsHopes for 2023 US Market. December 2, 2022 Survey Results

Again, a thank you to all who gifted a membership or a one-on-one zoom meeting to friends and relatives.

And again, our sincere gratitude to all members who took the time to respond to our Friday, November 18 survey about what they hope the market does in 2023. Time is an irreplaceable resource. We appreciate your involvement.

|

“What do you hope for the US market in 2023? |

|

|

Like most people, I hope that it rises. |

25% |

|

I hope that it drops to allow me to buy bargains. |

28.6% |

|

I don’t care. If it rises I will take profits. If it drops I will buy bargains. |

46.4% |

Investors who hope that the market will rise will be disappointed often. Investors who selected choice number two or three are only disappointed when the market moves laterally. It rarely does so.

We are delighted to note that 75% of our members are in that group and hope the other 25% start thinking that way.

You can read some helpful comments below.

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join Us