The risk-return tradeoff is, or should be understood by investors. In today’s low-interest rate environment, saving for retirement using low-risk securities is nearly impossible. So is comfortable retirement living.

Investors need to look elsewhere.

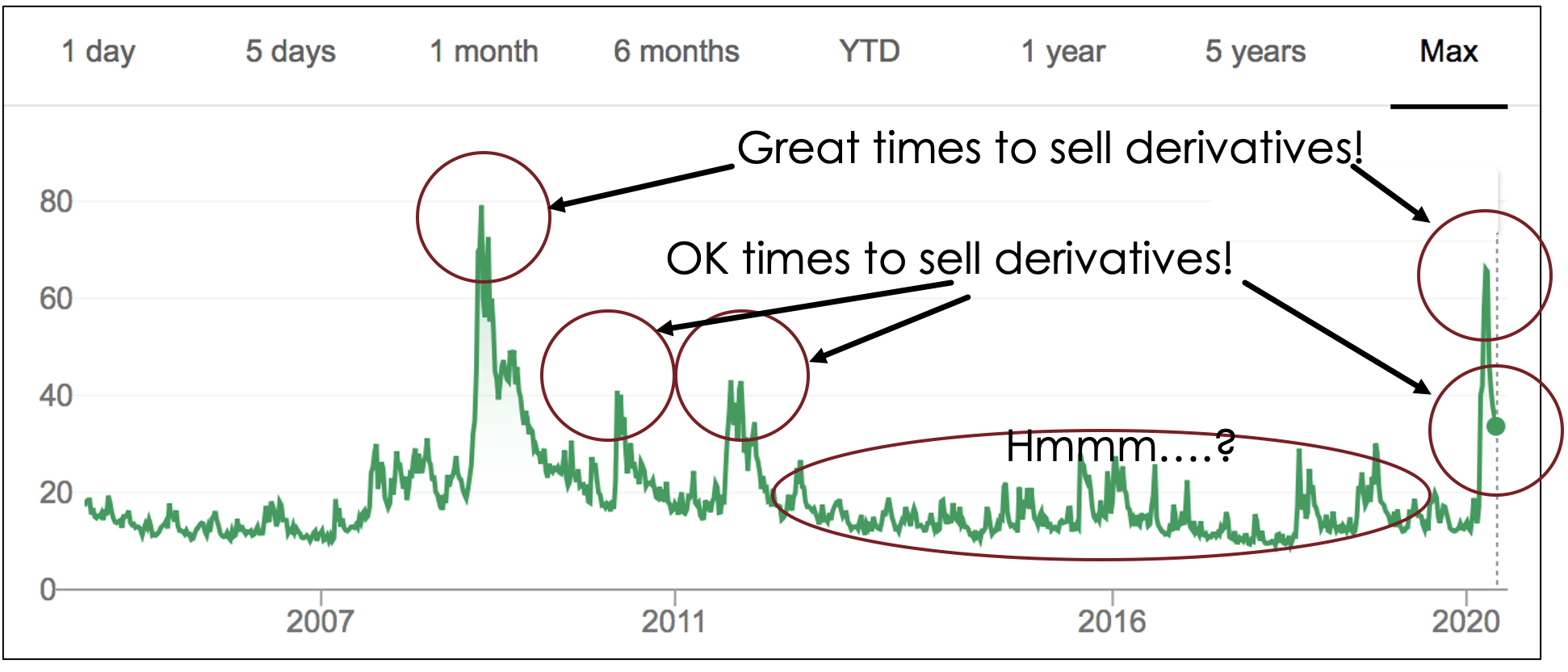

We know that premiums on selling derivatives can be high when VIX (market volatility) is high. The chart above shows the historically good periods for such investing in the US economy, the strongest in history. (Investors can do that buying an exchange-traded fund that represents the S&P 500 which itself mirrors the US market.)

When the VIX is above 65, the derivatives premiums can be very high. Last Friday, July 31, the VIX closed at 24.76! Nowhere near at an interesting level!

So, rather than look for a high market VIX, we decided to look for a high VIX (high Beta) on individual securities and then check the premiums on their derivatives. To be safe, we focussed on dividend aristocrats.

(If you are aware of an investment which produces great returns with safety, please share them with the rest of us.)

Of the 2,800 companies listed on the New York Stock Exchange, 64 qualify as dividend aristocrats. These companies have paid an increasing dividend for 25 consecutive years or more.

Among the 64, we found three which had a Beta greater than one. Among those three, we found one that had sufficiently large open volume to be interesting. That company is

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join Us