Studies show that nearly all money managers, financial advisers and individual investors think they are above average. Is that mathematically possible? No need to comment.

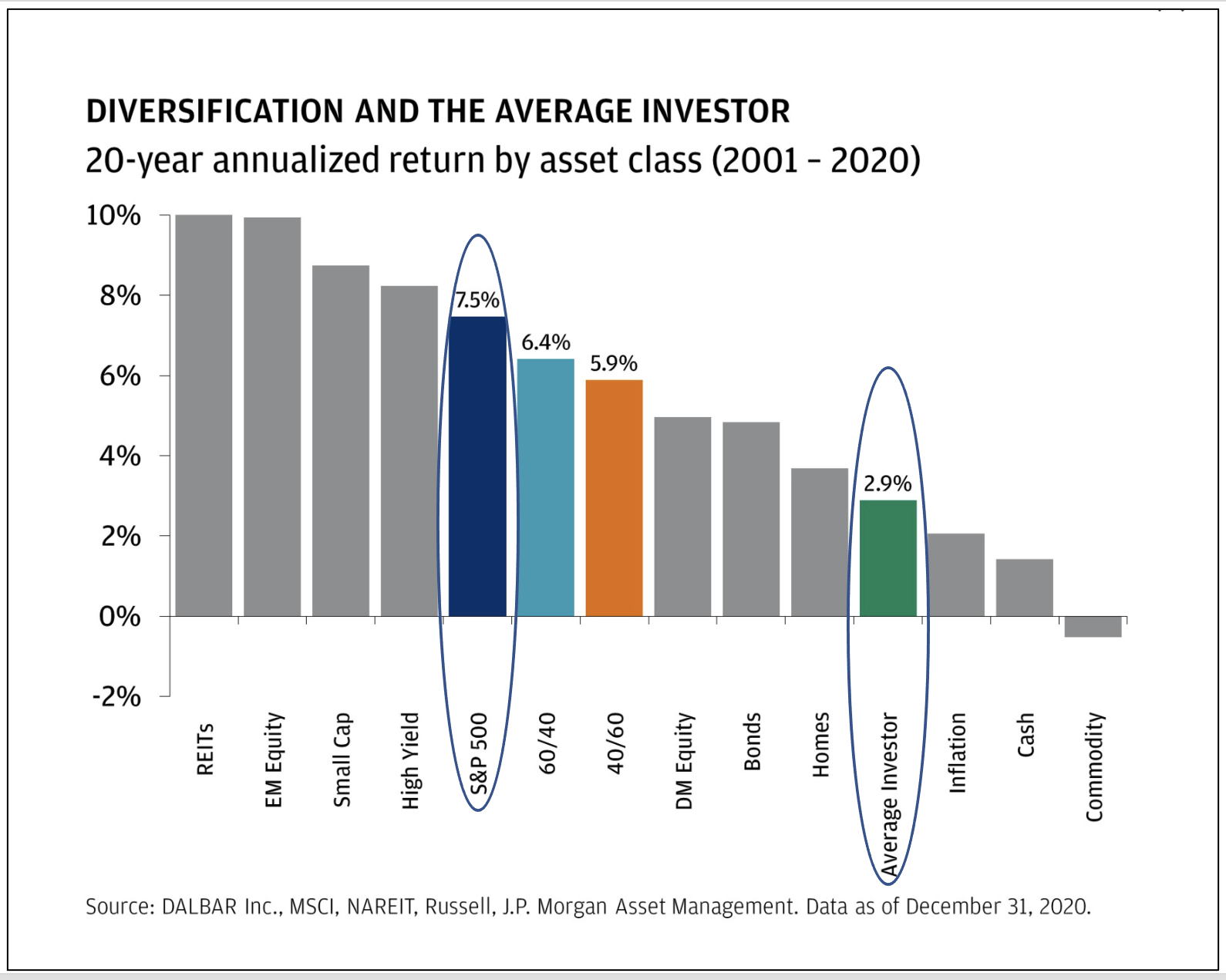

As the chart above shows, the average investor earns less than a half what the market, as shown by the S&P 500, delivers. It’s also well known that after fees, more than 90% of professional money managers cannot equal the S&P 500 over a market cycle (peak to trough to peak).

In less than half an hour, Monday Morning members can teach a high school student how to equal the S&P 500.

The chart also shows that REITs, Emerging Market equities, small-cap and high-yield securities outperformed the S&P 500 from 2001 and 2020.

Why did Monday Morning not recommend any of them?

Two reasons:

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join Us