In previous posts, we mentioned that our fearless, intrepid investor lost $US10,990.00 in her “fun” portfolio over one year by writing (selling) just out-of-the-money covered calls on Novavax (NVAX) on Mondays, expiry dates on Fridays of the same week. How much fun is that?

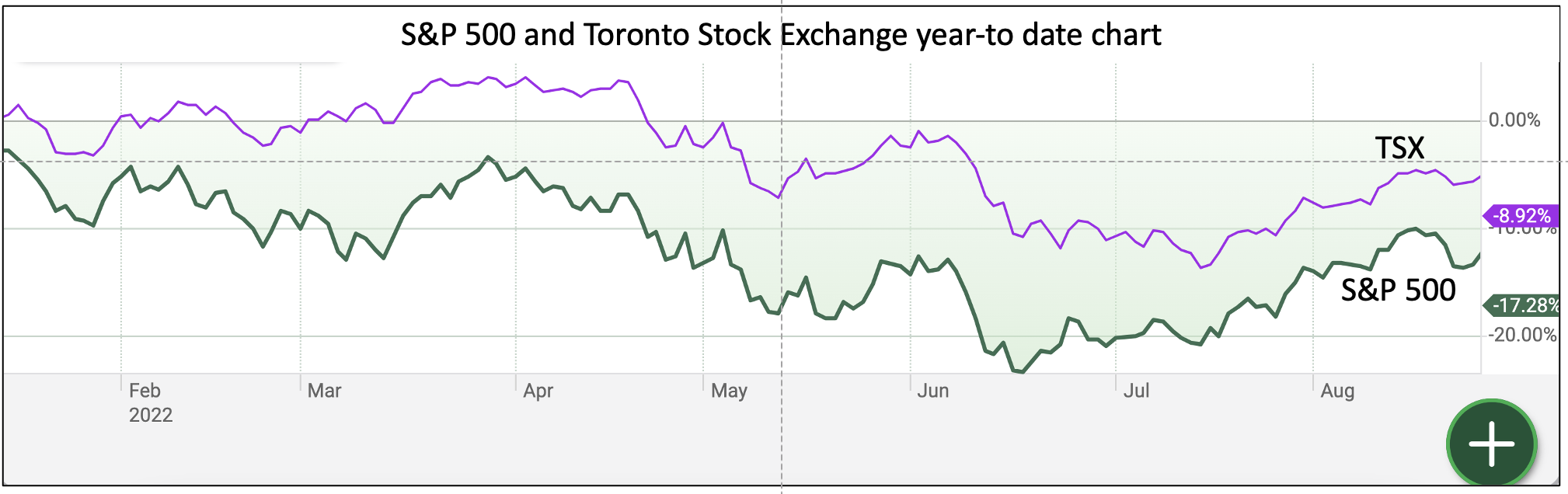

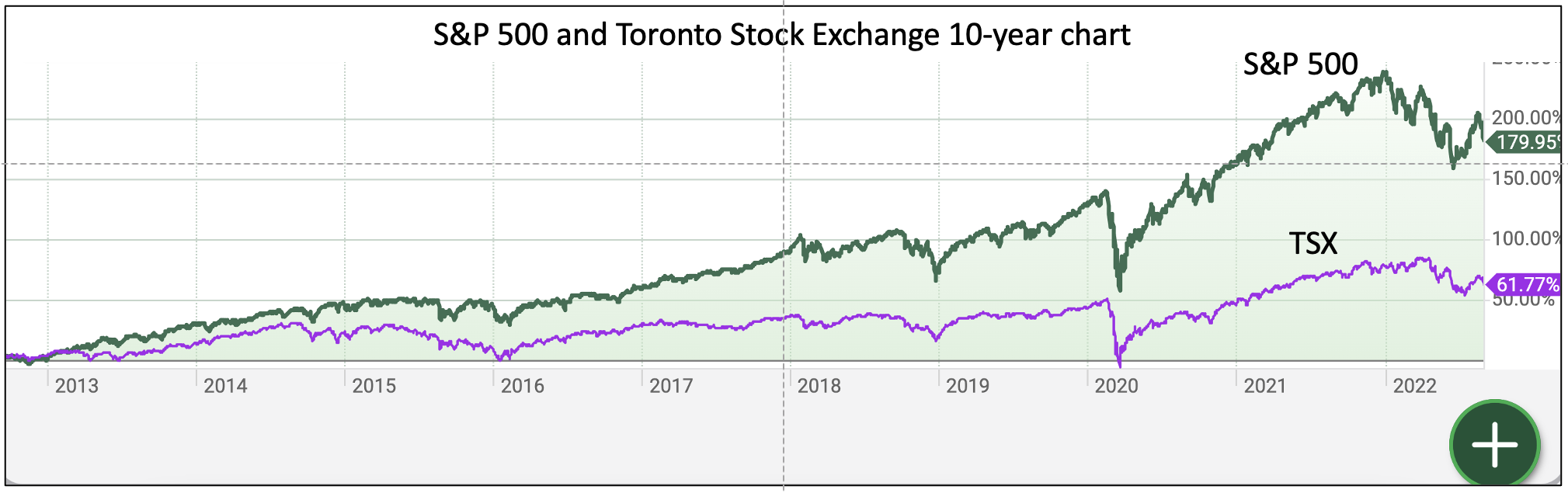

She ignored habit number three, which recommends that investors buy the American market as a whole and not pick individual stocks. Investors can buy the American market as a whole by acquiring an exchange-traded fund (ETF) that tracks the S&P 500.

There are more ETFs now than there are individual securities, but only half a dozen or so track the S&P 500. SPY is the best. It is the largest, oldest, and most heavily traded US ETF. It has the narrowest bid/ask spread, one of investors’ expenses that most tend to ignore.

All risk in selling covered calls comes from the market movement of the underlying security. When she owned NVAX, it dropped to a greater, far greater, extent than the premium income derived from selling covered calls on the security. So, no more writing covered calls on individual securities for her.

Further, she decided to write (sell) covered calls sufficiently out-of-the-money to earn about 1% per month or slightly more. That would significantly reduce the possibility of being assigned while yielding a decent return!

What did she do last Monday?

She sold covered calls on SPY at $8.00 out-of-the-money, expiry date Friday, January 6 (SPY C 06JAN23 390.00)

SPY rose by just under $8.00 last week, giving her a decent return.

What will she do today when the markets open at 9:30 AM?

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join Us