The above chart shows that investors who acquired Novavax (NVAX) at the beginning of 2020, have enjoyed a growth of over 2,100%!

The Monday Morning program recommends passive investing. However, some of our members are interested in seeing what one of our adventuresome members with a moderate level of risk tolerance, has been doing for about three months.

Last week (November 2, 2020) we posted a blog describing the investment history of one of our member’s portfolios.

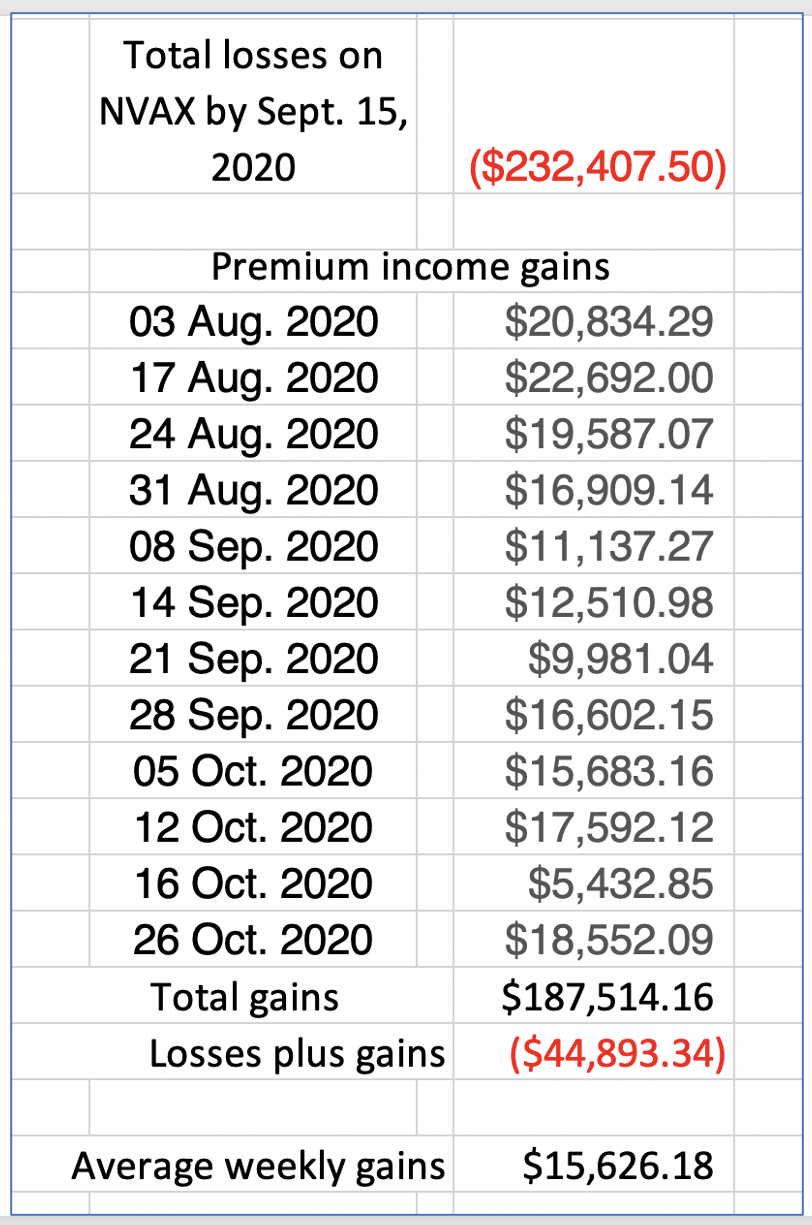

About three months ago, she committed about $500,000 to buy (NVAX) shares at over $174 per share because the premiums on covered calls were attractive! In short order, she lost $232,407.50 on the security itself.

The initial premium which she received didn’t even come close to covering the loss. However, she continued to sell just out-of-the-money covered calls each Monday with the expiry date on Friday of the same week. Also, when the NVAX price dropped, she bought more shares to bring down her overall per-share cost.

You can see her record below.

On November 2, she sold just out-of-the-money NVAX covered calls, expiry date Friday of the same week (November 6), and received $18,552.09. That trimmed her losses to $26,341.25 ($44,893.34 and $18,552.09).

Further, she bought another 700 shares of NVAX when the shares dropped to $82.74 thus lowering her per share-cost.

By Friday, November 6, NVAX shares rose to $89.71 and she was assigned.

When the market opens today at 9:30 AM Eastern Time, she plans to buy 4,000 NVAX shares at the market and sell 40 covered call contracts on them at a strike price of $90.00 and expiry date this coming Friday, November 13 (NVAX C 13NOV20 90.00).

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join Us